On Platts

The New York-based company is a Media Partner of SIEW 2011. It will be holding its 6th Annual Platts Top 250 Global Energy Companies Asia Awards Dinner on 2 November 2011 during the SIEW Energy Week. More details to be found

here.

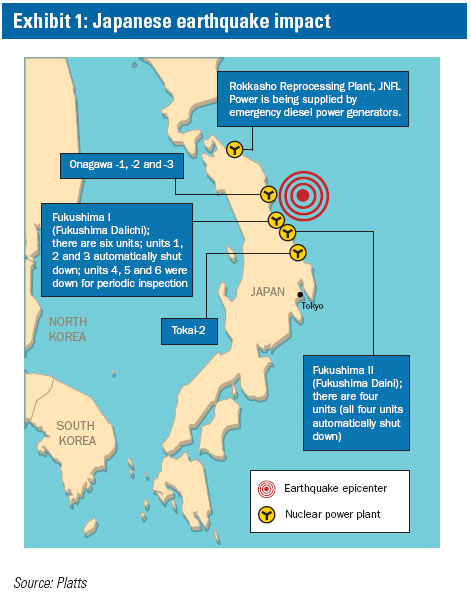

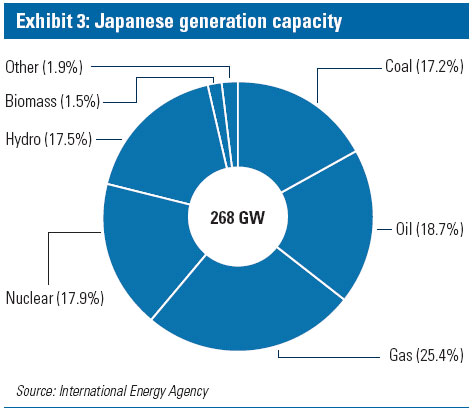

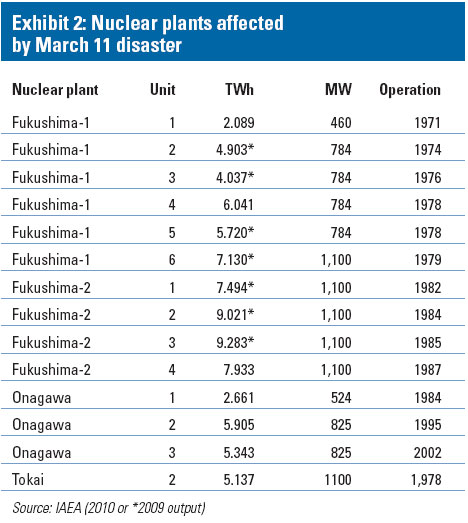

The 9.0-magnitude earthquake and resultant tsunami in northeastern Japan on 11 March affected more than 31,800 megawatts (MW) of generating capacity. In the immediate aftermath of the earthquake 11 nuclear reactors with 9,674MW of capacity at four sites shut down automatically, while three other reactors with 2,700MW of capacity which were closed for maintenance were also affected.

The Japan Atomic Power Company’s 1,100-MW Tokai Daini boiling water reactor (BWR) in Ibaraki prefecture shut down without apparent problems, although JAPC said on 13 March that two of three diesel generators used for emergency cooling had failed.

Meanwhile a fire occurred immediately after the disaster in a turbine building at one of the three BWRs at Tohoku Electric Power Company's 2,174MW Onagawa plant in Miyagi prefecture. It was extinguished without indications at the time of radioactive leakage.

Tohoku Electric subsequently said on March 12 that radiation levels at Onagawa had surged. But by March 14 radiation had fallen to normal levels, with the International Atomic Energy Agency (IAEA) saying that "the current assumption of the Japanese authorities is that the increased level may have been due to a release of radioactive material from the Fukushima Daiichi nuclear power plant".

Fukushima, which has experienced by far the worst problems, comprises two plants located 11.5km apart. Fukushima Daiichi (Fukushima-1) and Fukushima Daini (Fukushima-2) are both owned and operated by the Tokyo Electric Power Company (Tepco), with the Fukushima-1 complex comprising six BWRs with 4,700MW of capacity, while Fukushima-2 comprises four BWRs with 4,400MW of capacity.

All four Fukushima-2 reactors were operating at the time of the earthquake and shut down automatically, as did three units at Fukushima-1. The remaining three reactors at Fukushima-1 were already shut for scheduled maintenance.

The automatic shutdown of the Fukushima-2 reactors ran into cooling problems when emergency generators failed, apparently as a result of the impact of the tsunami on the generators or their diesel stocks. But much worse loss of coolant incidents occurred at Fukushima-1.

Since 12 March, when the structure housing the No.1 reactor at Fukushima-1 collapsed following a hydrogen explosion, reactors at the complex have suffered a succession of crises including radiation leaks and partial core melt resulting primarily from cooling problems. While the situation at the complex appears more stable but extremely serious at the time of writing, it will be months if not years before the radiation and other problems are controlled and the damage repaired.

Apart from the 12,374MW of nuclear capacity affected by the disaster, Tepco and Tohoku Electric have several other reactors out of action. Tepco has only 4,912MW of operational capacity at the 8,000MW Kashiwazaki- Kariwa nuclear complex, while Tohoku Electric's 1,067MW Higashidori No.1 reactor started a five-month maintenance programme in February.

Tepco is thus currently operating only 4,912MW of its 17,100MW of nuclear capacity, while all Tohoku Electric's reactors are offline as well as the Tokai Daini plant. More than 20,340MW of capacity at Japan's 47,500MW nuclear fleet is thus offline in the northeast alone, in a country where nuclear generates about 30 percent of all electricity.

Status of disaster-affected thermal plant

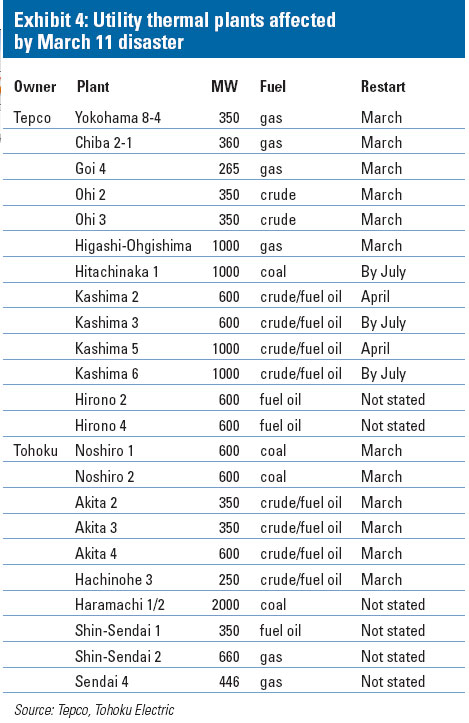

Apart from the nuclear shut downs, the disaster affected at least 19,445MW of fossil-fuelled plant owned by Tepco, Tohoku Electric and other generators. Some of this gas, oil and coal-fired plant is now returning to service.

The restart of Tepco's 1,000MW Higashi Ohgishima No.1 gas-fired unit in Tokyo Bay in late March meant Tepco had restored 2,675MW of its 8,475MW of thermal capacity closed as a result of the 11 March disaster. The capacity restored by the end of March included 1,975MW of gas and 700MW of oil-fired plant.

Tepco said on 25 March that it plans to start operating 4,200MW of the remaining 5,800MW of its thermal capacity shut by the disaster by July. The capacity includes the 1,000MW Hitachinaka No.1 coal-fired plant and 3,200MW of crude and fuel oil-fired units at the Kashima plant. Tepco was on the point of restarting the 600MW No.3 and 50 percent of the capacity at the 1,000MW No.5 oil-fired units at Kashima on 8 April.

Tepco has not given a schedule for restarting the 600MW No.2 and 1,000MW No.4 oil-fired units at the Hirono plant.

Apart from restarting plant affected by the March 11 disaster, Tepco had resumed operating 2,265MW of crude oil and gas-fired capacity at Futtsu, Goi, Ohi and Yokohama by 25 March after truncating or completing maintenance programs.

The company said on the same day that 3,700 MW more capacity under maintenance would be operating by the end of July, as would four units with 900MW of capacity at the mothballed Yokosuka oil-fired plant.

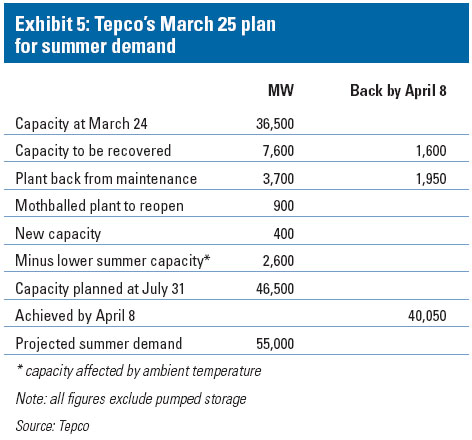

Excluding pumped storage plant, Tepco had 36,500MW of operating capacity on 25 March. By 8 April, a further 1,950MW of gas-fired plant at Kawasaki, Futtsu and elsewhere had returned from maintenance, taking its capacity excluding pumped storage plants to about 40,000MW after adding in the two restarted units at Kashima.

Meanwhile, Tohoku Electric lost 6,200MW of thermal capacity to the disaster, but had estarted plants with 2,750MW of capacity within a couple of weeks. This included 1,200MW of coal-fired plant at Noshiro and 1,550MW of crude and fuel oil-fired units at Akita and Hachinohe.

Still closed are Tohoku Electric’s two 1,000MW coalfired units at Haramachi, a 350MW fuel oil-fired unit and 600MW gas-fired set at Shin-Sendai, and the 446MW No.4 gas-fired plant at Sendai. But against these losses Tohoku Electric has said the mothballed 350MW No.1 gas and oil-fired unit at the Higashi-Niigata generating complex at Minato is due to start operating in June.

Following the April 7 earthquake, Tohoku Electric again shut the Hachinohe, Noshiro and Akita units. But it was already restarting the various units, a company official said on 8 April.

Apart from plants owned directly by Tepco and Tohoku Electric, several other thermal plants were affected by the disaster.

These include the 2,000MW Soma Kyodo coal-fired plant at Shinchi, which is operated by an equal joint venture between Tepco and Tohoku Electric. One of the two 1,000MW units was already closed for maintenance while the other unit was shut by the disaster.

The Joban Joint Power Company, in which Tepco and Tohoku Electric each hold 49.1 percent stakes, has said that its units at Nakoso in Ibaraki prefecture are all shut.

The 250MW No.7 coal-fired and 600MW No.9 coal and oil-fired units were shut by the tsunami, while the 600MW No.8 coal-fired unit was already shut at the time for maintenance.

The Kashima Kyodo Electric Power Company, an equal joint venture between Tepco and Sumitomo Metal Industries which supplies its output equally to its parents, was also affected. One of the three 350MW fuel oil, blast furnace and coke oven gas-fired units at the plant was closed for maintenance on March 11, but the other two were shut after the earthquake.

Power shortages loom

The closure of the nuclear and thermal plants forced Tepco and Tohoku Electric to impose rolling power cuts in their service areas from 14 March. But the gradual restart of fossil-fueled plant affected by the disaster or returning from maintenance, as well as the start up of mothballed plant and commissioning of emergency generators, has eased the pressure for the coming months.

At the time of writing the demand-supply balance in Tepco’s area was close but not negative. As a result Tepco said on 8 April that it was suspending the rolling outages until at least the end of May.

Excluding pumped storage and hydro plant, the availability of which Tepco noted is uncertain, the available generating capacity in the service area of the country's largest utility had risen from 33,000MW on 16 March to about 40,000MW on 8 April. Other plants identified as potentially operational by the end of July are set to take the total then to 46,500MW.

But as the year advances and demand rises the situation looks set to change for the worse. Tepco projects that its summer peak demand will reach 55,000MW, while some forecasts have put the potential level at 60,000MW, implying a summer peak shortfall of up to 13,500MW.

Government and industry attempts to curb demand may narrow the supply-demand gap. In early April the Nikkei business newspaper said the government may ease regulations to encourage energy conservation and add supply. The changes could allow coordinated manufacturing plant operating hours, permit the temporary installation of captive generators, and curb the use of air conditioners.

Implementing "cartelised" operating hours would usually fall foul of the Anti-Monopoly Law and Fair Trade Commission, while captive generators usually face stringent and time-consuming land zoning and environmental approval processes. And limiting airconditioner use at offices, department stores and public buildings could breach labour and building maintenance laws, the Nikkei report said. By easing such rules and imposing some compulsory energy conservation measures, the government said on 6 April that it hopes to reduce summer energy usage by 25 percent.

The federation of industry associations, Keidanren, has separately tasked its members with cutting grid power usage by 25 percent by stopping some production lines and operating their own generation facilities. It argued that the uncertainty and disrupted production resulting from planned rolling blackouts is worse than managing demand.

Economic recovery

Whatever the eventual impact of such measures, July to September looks likely to be the crunch period. The air conditioning-driven summer peak demand period typically occurs during the third quarter, and this is the time when many analysts believe that Japanese economic activity will start to rebound.

Infrastructure reconstruction and the wider rebuilding program should then be in full swing, while, less certainly, it is seen by some analysts as the time when the economy as a whole will rebound from the disaster.

The timing of the rebound is uncertain because some aspects of economic activity, notably consumer spending, will be influenced by sentiment as much as underlying fundamentals.

While the economic cost of recovering from the earthquake and tsunami is enormous--the Cabinet Office has estimated that it could reach 25 trillion yen (US$309 billion)--it is not expected to have as big an impact as at one stage feared. The Cabinet Office projects the damage to Japanese growth in 2011 at a relatively low 0.5 percent.

Similarly, almost all of the eleven local economic institutions surveyed by the Nikkei business newspaper in early April believed the economy would grow again from the third quarter.

While their averaged view was that the economy would shrink by 2.6 percent on quarter in April-June as personal consumption and exports fell, their averaged projected on-quarter increase for July-September was 1.2 percent, while fourth-quarter growth was expected to reach 5.6 percent.

Avoiding a summer capacity shortfall of up to 13,500MW in the Tepco area alone is thus a priority to avoid any drag on the anticipated economic recovery. Apart from government measures, the prospective shortfall in capacity is resulting in short- to medium-term measures to bridge the gap. For instance, the local broadcaster NHK reported within days of the disaster that the US' General Electric was preparing to send 10 gas turbines to Tepco.

In early April, the UK-based Aggreko plc agreed to supply Tepco with 100MW of gas-fired and 100MW of dieselfired plant for a "minimum one-year term". The units will be installed in the Tokyo Bay area and are "expected to start delivering power to the grid in June", Aggreko said.

At about the same time the Electricity Generating Authority of Thailand said it was lending two 122MW gas turbines to Tepco for a three- to five-year period.

The decommissioned units at the state-owned utility's Nong Chak power station near Bangkok will be shipped to Japan by Tepco and the Mitsubishi Corporation for operation by August.

These moves will be facilitated by a government statement on 5 April that Tepco will be exempted temporarily from the need to conduct environmental impact studies before expanding and building fossil-fuelled plants. The studies and related approval processes normally take up to three years.

Private generators are also providing power to Tepco where feasible. For instance Sumitomo Metal Industries resumed operating its 475MW Kashima on 25 March and will supply all the output to Tepco.

Meanwhile, steelmaker JFE Steel has said that its 390.8MW gas-fired independent power producer plant in Chiba prefecture has tripled its output, with all the power being supplied to Tepco.

All these measures will be needed because, while disaster-affected fossil-fired plants may resume operation within months, the 12,374MW of affected nuclear capacity may remain shuttered for years. And some if not all of the Fukushima-1 reactors will not operate again.

The permanent closure of the 2,812MW of capacity at reactors one to four at Fukushima-1 was indicated on 30 March by Tepco chairman Tsunehisa Katsumata. He said the use of seawater to cool the reactors after they lost their cooling systems meant the company almost certainly "would have to scrap them".

Given the proximity of the fifth and sixth reactors at Fukushima-1 to the other units, the entire 4,696MW of capacity at the complex may be regarded as likely to close. Meanwhile the Fukushima-2, Onagawa and Tokai Daini plants are not expected to return to operation in the near term, given Japan's stringent and protracted nuclear safety inspection procedures after such shutdowns.

The period over which the plants might be closed can be gauged from the time taken to reopen Tepco's Kashiwazaki-Kariwa nuclear complex after the July 2007 earthquake. The plant was fully closed for two years and even now--almost four years later--only four of the seven reactors have resumed operation.

There is potential for even longer delays this time since the government is imposing revised safety rules for nuclear plants, and mulling a full-scale restructuring of the agencies that administer nuclear safety policy and inspections. The revised rules led Kyushu Electric Power to say on March 25 that it was postponing indefinitely the restart--originally planned for early April--of its 559MW No.2 and 1,180MW No.3 reactors at Genkai.

Kyushu Electric subsequently said it hoped to restart the reactors by late May, since the new government measures were less stringent than it had feared. But the more optimistic restart date is still predicated on the utility's early receipt of approvals from both the central government and local authorities.

Replacing nuclear output

The extended closure of the reactors means their output could need to be replaced for years to come by a substantial, albeit step increase in fossil fuel use.

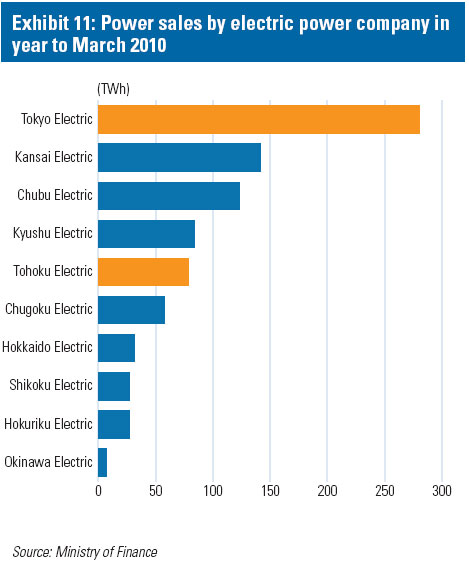

Moreover, most of this will have to be used in plants embedded in the Tepco and Tohoku grids, given the limited interconnectors between these power companies in the east of the country, which runs on 50Hz, and the 60Hz-based electric utilities in the west.

The only links on Honshu are the 600MW Shinshinano, 300MW Sakuma and 100MW Higashi Shimizu conversion stations. In addition 300MW is available from the Hokkaido-Honshu interconnection facilities with Hokkaido Electric.

How much additional fossil fuel will be needed is a moot point. And whether oil, gas or coal will be the main beneficiary is a second moot point.

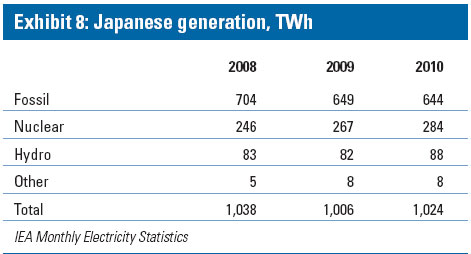

Estimates of the fossil-fired output needed to replace the closed nuclear plants vary. Based on the IAEA's individual reactor production figures for 2009 and 2010, the 14 reactors in the affected area produce up to 83TWh/year, although the International Energy Agency has suggested a lower replacement figure of 60TWh/year. The figures equate to a range of 200,000 to 275,000 barrels per day (b/d) of oil equivalent.

Projections of the different fossil fuels needed to replace the closed nuclear output also vary. One way of gauging the possible fuel choice is to look at what happened when all the reactors at Tepco’s Kashiwazaki-Kariwa complex were closed by the July 2007 earthquake.

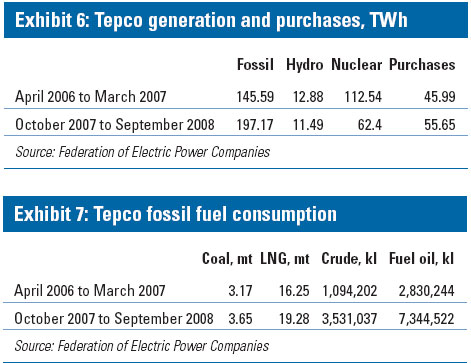

In the 12 months to March 2007 Tepco produced or bought 317TWh of power. In the 12 months to September 2008--the period worst affected by reactor closures--it produced and bought 327TWh. Compared with the earlier 12-month period, nuclear output almost halved to 62.4TWh, hydroelectric output was a little lower at 11.48TWh, power purchases increased 21 percent to 55.65TWh, and fossil-fuel generation jumped by 35.4 percent to 197.17TWh.

The additional fossil generation was not spread evenly across the different fuels. Tepco’s coal use rose from 3.17 million metric tonnes to 3.65 million mt between the two periods--an increase of 15 percent. Meanwhile, the utility’s LNG use rose by 18.6 percent from 16.25 million mt to 19.28 million mt.

But in percentage terms the big winners were crude oil, consumption of which more than tripled from 1,094,202 million kiloliters to 3,531,037 million kl, and fuel oil. The latter saw consumption rise almost threefold from 2,830,244 million kl to 7,344,522 million kl.

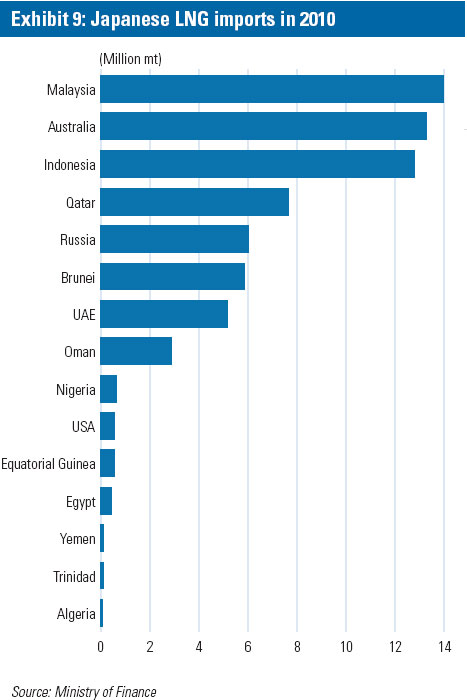

LNG to the fore"liaising with its Japanese counterparts to supply immediate additional LNG cargoes from its LNG portfolio", and is "working with its buyers in the Far East, who are not affected by the earthquake and tsunami, on possible cargoes swaps, advancements and diversions to cater for the increase in LNG requirements". Malaysia is Tepco’s largest long-term LNG supplier and also sells to Tohoku Electric.

Indonesian state energy company Pertamina has scrapped a tender for six spot LNG cargoes, which will be diverted to Japan. Indonesia may also divert LNG from Tangguh originally allocated to the US-based Sempra to Japan.

Meanwhile, Russian Prime Minister Vladimir Putin has offered to increase pipeline gas deliveries to Europe in order to divert LNG shipments to Japan. And from Qatar, Qatargas' Chief Executive Sheikh Khalid Al-Thani has said that "more Qatargas supplies have been directed to Japan" away from Europe, adding that "we will see convergence between Asia and Europe" spot LNG prices as a result.

It appears likely that part of the additional LNG demand will be met by short-term, meaning one to two-year, contracts. But spot purchases are also expected to rise, especially as electricity demand starts building towards the summer peak.

The crisis had an immediate impact on LNG prices as the scale of the disaster and its implications for gas requirements became apparent. Platts' Japan Korea Marker (JKM) jumped from US$9.40/MMBtu on March 10 to US$9.90/MMBtu on March 11 and US$11.00/MMBtu on March 14. By 8 April, it was over US$12.10/MMBtu.

Coal potential

As to coal, there appears to be no spare coal-fired capacity in the affected areas at present. An indication of this is that Tepco and Tohoku Electric declared force majeure on some shipments of imported thermal coal in the aftermath of the disaster, as did Joban Joint Power.

And as Japanese coal-fired plants usually operate on baseload, the potential to use more coal in alreadyoperating plants is likely to be very limited in the near term.

Indeed, in the near term coal demand could fall as plants and their coal delivery infrastructure are repaired. A market source told Platts in late March that "Tokyo and Tohoku's total coal consumption is 60 million metric tonnes [per year], and quite a large proportion of this is likely to be cancelled".

Japanese thermal coal imports were running at 125 million mt/year prior to the disaster and some market commentators believe Japan’s overall demand for thermal coal could drop by 12 million mt in 2011, or 10 percent.

In similar vein, Platts was told by a Japanese coal trader in late March that imports in the year to March 2012 could decline by between 12 and 17 million mt.

How quickly Haramachi, which uses 5 million mt/year, Hitachinaki, Soma Kyodo and Joban return to operation will be the key issue. Tepco has said that Hitachinaki will be back before the end of July, but firm restart dates for the other plants are awaited.

The impact on coal prices has thus to date been limited. After a spike immediately after the disaster, prices have been muted in part as displaced exports to Japan have sought new markets.

Oil potential

Replacing lost nuclear capacity in the short term may thus largely come down to the choice between using more LNG, often through the baseload operation of plants that usually run at intermediate or peak load, or using more crude and fuel oil.

In terms of the overall requirements, Goldman Sachs has said that additional oil demand could be about 247,000 b/d. Barclays Capital has gone lower, saying that 210,000 b/d of additional oil could be required to help replace lost nuclear output, including 143,000 b/d of fuel oil and 67,000 b/d of crude oil.

Additional crude supplies have already been sourced, for instance from Indonesia. West African, Vietnamese and other crude grades have also been discussed as possible alternatives.

As a result prices of the direct-burning crude grades that can be used for power generation in Japan rose to near three-year highs on 1 April, according to Platts data. The price for Indonesia’s Minas jumped to US$121.65/b, while crude grades such as Indonesia's Duri and Vietnam’s Bach Ho have also traded at high levels on the back of demand from Japan.

On the fuel oil front only three oil refineries remained shut in early April because of damage suffered on March 11.

The 0.618 million b/d of capacity still shut was well down on the 1.4 million b/d of refining capacity shut or curtailed in the immediate aftermath of the earthquake.

The refining capacity lost on 11 March accounted for 31 percent of the country's then capacity of 4.52 million b/d, which is believed to have since increased to 4.62 million b/d. Moreover, refineries in western Japan had increased their crude run rates to more than 100 percent of design capacity by late March, according to the Petroleum Association of Japan (PAJ).

With refineries returning to operation at a fast pace, the ability to provide additional fuel oil as well as crude to replace lost nuclear output may thus occur faster than at one time appeared likely.

However, the amount of oil used to replace lost nuclear output will not necessarily translate into an equal increase in nationwide oil demand, at least in the near term. For instance Kyushu Electric Power has said that it may face some difficulty in securing fuel for its oil-fired plants because refiners have been prioritising supplies to the earthquake-hit northeastern generators.

Kyushu Electric said that it used about 890,000kl of crude and fuel oil in the year ending March 2011. But in the year ending March 2012, it plans to consume 360,000kl of crude and fuel oil.

Even Tepco's demand may not be that different. PAJ President Akihiko Tembo told a press conference on 1 April that the utility's incremental oil demand in the summer could be limited, in part because the Hirono plant may not return to service in the near future. Tembo noted that when the 2007 earthquake hit nuclear production at Kashiwazaki-Kariwa, Hirono had helped account for the then surge in oil demand.

Longer-term trends

Over time, the balance between crude, fuel oil and gas may shift somewhat, while coal use should rebound as facilities are restarted. In this context it may be worth noting that between 2007 and 2010 crude and fuel oil use fell much more sharply than gas or coal as nuclear capacity returned after the 2007 earthquake.

There may also be changes to the seasonal pattern of fuel use, at least in Tepco's service area. As before, crude and fuel oil use may be expected to spike during the summer and winter peak periods, but LNG use may see a more uniform consumption profile across the year if it picks up more of the baseload burden.

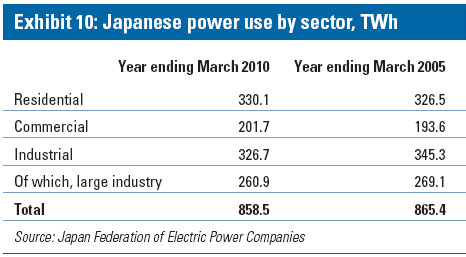

An existing trend in the Japanese electricity market may also be accentuated by the disaster. In recent years a large amount of industrial production has moved offshore. While often driven by lower labor costs, Japan's high electricity prices have also been a factor, with much of the relocated industry being energy-intensive.

The upshot is that the share of electricity used by large industrials, which often show a relatively uniform seasonal and diurnal pattern of consumption, has been declining compared to the share of commercial and especially residential customers. The latter's consumption is intrinsically more peaky, both diurnal and seasonal, and subject to weather-related spikes.

Over the past year or so this trend has been less apparent as heavy industry electricity consumption rebounded from the 2007 global economic crisis. But the underlying trend appears to be for increasingly peaky electricity demand, and the March 11 disaster could accentuate this long-run shift.

While the main impact will obviously be in the Tepco and Tohoku Electric areas, it is also possible that northeastern reactors will not be the only nuclear plant out of service for the next year or so. As with the Kyushu Electric reactors, units currently under maintenance may face a delayed return to operation. And some of the country's older operating reactors may face closure ahead of schedule if they are perceived to face the same risks as the Fukushima-1 units.

Assuming that nuclear output will gradually recover as it did after the 2007 earthquake may also be open to question. Apart from the closure of existing reactors, the Japanese nuclear expansion programme--which envisages that 14 new reactors will enter service by 2030--is in tatters.

Tepco said on 17 March that it was discontinuing construction work on the Tepco Higashidori nuclear project in Aomori prefecture. Tepco had said as recently as January that it was starting construction of the 1,385-MW Higashidori No.1 reactor after it received final approval.

Tepco said then that the advanced boiling water reactor was scheduled for operation in March 2017. Tepco also said that it would seek approval for a second 1,385MW reactor at Higashidori, although construction of the No.2 reactor would not start until after March 2015.

Also in Aomori prefecture, J-Power told the prefectural authorities on 17 March that it was temporarily suspending work on the 1,383MW Ohma project. The plant is scheduled to enter operation in November 2014.

Ohma is one of only two nuclear reactors currently under full construction in Japan, according to World Nuclear Association (WNA) data. The other is the Chugoku Electric Power Company's 1,383MW Shimane-3 reactor.

Chugoku Electric has seen its own nuclear program hit by the crisis, with the Yamaguchi prefectural government asking it to suspend initial construction work on the Kaminoseki project, which will comprise two 1,373MW advanced boiling water reactors. Prefectural officials asked Chugoku Electric to assess the events at Fukushima-1 and take appropriate action prior to resuming work.

Chugoku Electric has only done initial work to date on the Kaminoseki project, which has faced strong local opposition. This had already led to a two-year delay in December 2009, when Chugoku sought government approval to proceed.

The start of operation of the No.1 reactor was then expected in the year ending March 2018, based on the start of full construction in June 2012. The second reactor was then scheduled to begin operating in 2020.

With the two Kaminoseki reactors and two Tepco Higashidori reactors suspended, and Tepco’s planned seventh and eighth reactors at Fukushima-1 now cancelled, half of Japan's 12 planned reactors as listed by WNA are now in question. Moreover the remaining six reactors include Tohoku Electric's Higashidori-2 and Namie-odaka reactor projects, which may also come into serious question.

This leaves only 6,046MW of capacity at Tsuruga, Hamaoka and Sendai certainly at the planning stage, plus the 2,766MW of constructing capacity. With at least four reactors with almost 3,000MW of capacity at Fukushima-1 now gone and several other reactors approaching the end of their life, Japanese nuclear capacity looks set to stagnate or decline rather than grow for the foreseeable future.

Whether this indicates the wholesale reconfiguration of the Japanese electricity market is, however, less certain. There will certainly be a renewed push for renewable and new energies, although past initiatives have yielded limited capacity, and there will be greater fossil fuel use. But there will still be a substantial nuclear fleet in a country where seismic risk has generally lost out to the need for diversified and secure energy supplies.

Industry reform ahead"the enormous costs the company will incur as it recovers from this disaster, including costs for replacement power, the building of new generation plants to replace the permanently damaged plants, and the decommissioning of the contaminated plant".

Apart from rebuilding its plants and infrastructure, and decommissioning the Fukushima-1 reactors, Tepco may also face massive claims for damages relating to the radiation leaks. Yusuke Ueda, an analyst at Bank of America Merrill Lynch, has said that Tepco could face a compensation bill of up to 3 trillion yen if bringing the plant under control takes six months, the timeframe Merrill Lynch believed most likely.

Who will pay the bill is still unclear, with Tepco saying the Atomic Energy Damage Compensation Law does not specify whether a company or the government is responsible for compensation when a natural disaster damages a nuclear plant. Either way, the government looks set to be the backstop.

The final outcome of the disaster may thus be limited, both in its impact on the Japanese energy economy and the structure of the country's electricity supply industry. But the impact across the global electricity business and commodity markets has still been profound, and will continue to be so for months and years to come.

By : Ema