From nuclear power crisis to rising oil issues, there has never been greater urgency to pursue energy security in Asia. Taken from the FT Energy Book commissioned by SIEW, this article looks at what the region is doing to secure its fuel mix.

Asia's prolonged economic boom has depended on cheap oil prices. But when prices surged in 2008, approaching US$150 a barrel, the region felt firsthand just how vulnerable it was to oil price shocks. Asian governments rushed to cut energy subsidies to protect their finances and those of state-owned energy companies. As crude oil pushed through US$135 a barrel for the first time, Taiwan, Malaysia and Indonesia took urgent action to free prices or cut subsidy costs. India soon followed and China was forced to absorb a massive hit to its refineries.

Since then, there has been even greater urgency for energy security in Asia. "The overriding concern of member countries is supply security," said Nobuo Tanaka, Executive Director of the International Energy Agency (IEA). "Can we get enough energy sources for economic growth" We have experienced a very volatile oil market--it went to US$147 per barrel and then came back and then went up again. So volatility is a source of great concern. We are consumer countries, not producers, and what we can do is limited. But the important issue for Asia is how can we conserve energy and use it more efficiently"

The Asian growth story

The energy demands of the ASEAN-six countries have exploded over the past two decades, from 230 million tonnes of oil equivalent (Mtoe) in 1990 to 490 Mtoe in 2007--equal to four percent of the world's energy demand. Electricity generation in these countries, meanwhile, increased nearly fourfold over the same period, according to the International Energy Agency. Asia's growth far outstrips the rest of the world. Demand for energy is expected to grow at 2.4 percent a year, compared with the rest of the world where energy demand growth is estimated to rise just 1.5 percent a year over the next two decades. The Asian energy landscape, meanwhile, presents a mosaic of different policies and solutions.

Indonesia is juggling revenues from exports of oil, gas and coal while ensuring domestic supplies. Thailand's experiment with the independent power producer (IPP) market is attracting attention from the developed world and Vietnam's growth is so fast it is struggling to keep up with demand. Singapore and the Philippines, meanwhile, are re-examining privatisation of their electricity assets. As Peter Chin, Malaysia's Minister of Energy, Green Technology and Water, explained, governments are also making large savings where they are easiest.

"In energy efficiency (EE), we are in the midst of finalising the EE masterplan. We believe that EE would be the low hanging fruit to be reaped immediately," he told delegates at the Singapore International Energy Week last November. "In fact, it is said that 40 percent of energy savings could come just from EE initiatives in buildings. I have mandated that we will abolish incandescent lights in 2014."

Capital constraints of energy-efficient technologies

S. Iswaran, Singapore's Senior Minister of State for Trade and Industry, also highlighted the gains to be achieved from energy efficiency at the Singapore International Energy Week. "The International Energy Agency (IEA) has estimated that current energy use in the OECD countries would be 63 percent higher if not for energy efficiency improvements that have been achieved over the past 35 years," he said. However, he added that the main impediment the high upfront capital costs and capital constraints of energy-efficient technologies.

"Especially in the face of other investment opportunities and priorities," Iswaran said. "Ensuring adequate financing and the careful design of financing incentives will be important in addressing these market failures and barriers."

India's Power Minister, Sushilkumar Shinde, said his government was focusing on ways to finance renewables and had created renewable energy certificates to help utilities reach their minimum purchase levels of green power. "The REC mechanism also aims at encouraging competition and eventually mainstreaming renewable energy sources," he said, adding that the certificates were helping utilities buy power beyond the scope of their regulatory requirements.

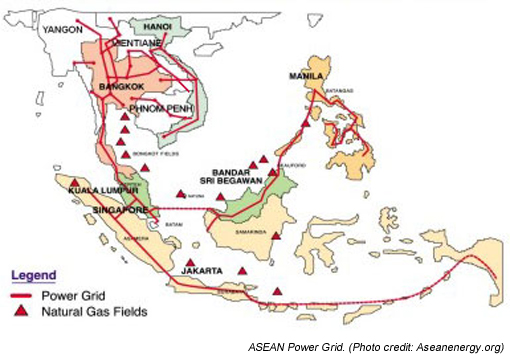

Regional cooperation, meanwhile, is assuming greater importance as disparate economies find common cause in the face of rising oil prices. Initiatives such as the ASEAN Power Grid (APG) and the Trans-ASEAN Gas Pipeline (TAGP) are shaping the future of Asian energy requirements.

One of the region's flagship projects, the APG--part of a master plan endorsed by ASEAN leaders in October 2010--plans to connect 15 projects to form a power grid that spans the region. Currently, the APG is progressing with four interconnection projects. An additional 11 projects are planned for connection through to 2015. The US$5.9 billion initiative is expected to reap savings of US$662 million as synergies feed into operating costs.

Asia currently has 13 of the world's 26 mega cities--defined as cities with populations of more than ten million--and providing for an increasingly urbanised environment will hinge on the ability to move resources around the region quickly and efficiently. Asia's consumption alone will be enough to shift the axis of global energy demand.

"The global energy landscape has witnessed a significant evolution in recent years," Iswaran said. "One key driver of this change is Asia's strong economic growth coupled with rapid urbanisation, which will continue to fuel the increasing demand for energy in the world." The other pillar of the ASEAN Vision 2020 programme is natural gas. Achieving long-term security, availability and reliability through regional cooperation is the aim of the TAGP, one of the most ambitious projects of its type in the world.

The US$7 billion project involves the construction of 4,500km of undersea pipelines, augmenting the eight bilateral gas pipeline interconnection projects currently in operation. Measuring a total length of 2,300km, these interconnections will form the backbone of energy security and sustainability for the ASEAN region, and are expected to be accelerated by 2015 and ready with a regional gas grid by 2020. However, one critical factor for the region will be securing a dwindling supply.

With ASEAN countries consuming ten billion cubic feet per day, according to the ASEAN Centre for Energy, and regional demand expected to grow in the vicinity of seven-eight percent a year, studies show that the supply gap will begin to bite by 2017 and rise to 12 billion cubic feet per day by 2025.

While options to address the shortfall include exploration and new discoveries, as well as increased imports of LNG gas and the development of coal bed methane, the ASEAN region is likely to depend on the East Natuna gas field in Indonesia. Reserves here are estimated at 45,000 billion cubic feet excluding CO2.

National gas advantages manifold

According to Malcolm Brinded, Executive Director of Upstream International, Shell, the advantages of natural gas as an energy source are manifold. "According to the IEA, global gas resources are now equal to 250 years of current production," Brinded said. "This is great news for the world because natural gas is by far the quickest and cheapest way to cut CO2 emissions from the power sector.

"Modern gas plants emit half the CO2 of modern coal-fired power plants and up to 70 per cent less than old steam turbine power plants, of which there are many hundreds still operating in the US, Europe, China and elsewhere."

He said gas-fired plants are now cheaper to build than any other new-build plant and are a perfect complement to alternative energy technologies such as wind and solar because the former has the ability to be dialled up or down depending on demand. Shell estimates that new-build gas-fired power plants require half the capital cost of coal per megawatt hour, one-fifth the cost of nuclear, 15 percent of onshore wind, and less than one-tenth the cost of offshore power.

"At Shell, we estimate that global demand for gas could grow by 50 percent by 2030 and that Asia could account for half of this," he said. New technology is likely to keep pace with this growth in demand, with new processes for extracting gas in tight sands, shale and coal-bed methane likely to come to the fore over the next few decades.

"Just 10 years ago, the industry considered these too difficult and too costly to access, but the huge progress that's been made in drilling and fracturing these rocks to release this gas, tapping the resources profitably and safely, has transformed the industry," Brinded said.

LNG: A new hope for diversification

In Southeast Asia, ASEAN member states are also building LNG terminals to supplement their energy needs and developing strategies to strike a supply-demand balance for gas to be used in the TAGP, in view of the growing regional gas demand.

"The second driver of the global gas revolution is the rapid expansion of the LNG market on the back of new supplies and new markets," Brinded said. "This is especially true of Southeast Asia where many countries are preparing to import LNG, including Malaysia, Thailand, Vietnam and Singapore from 2013."Such growth of LNG and unconventional gas resources will work together to hugely expand the international market for natural gas and greatly reduce the rate of CO2 production as gas-fired power reduces the need for more coal," he said.

Singapore's commitment to LNG is providing a litmus for the rest of the region in terms of diversification and augmenting the Republic's supplies from piped gas. "Our first priority in diversification is to diversify our sources of gas by importing LNG – liquid natural gas – because once it is liquefied it can come from anywhere in the world," said Singapore's Prime Minister Lee Hsien Loong. "We are building an LNG terminal. It will be ready by 2013 and that will allow us to plug into the global gas market and access gas sources from around the world.

"Indeed, under the contracts we have, some of the initial gas which we will be getting will come from halfway around the world, from Trinidad and Tobago. And it is hard to get further away than that."

Fossil fuels and the future

Nevertheless, coal can still be expected to remain a large part of the Asian energy mix for some time to come. According the IEA's World Energy Outlook, coal demand is set to jump by 38 percent by 2015 and soar to 73 percent by 2030. This is equivalent to an annual growth rate of 6.9 percent, making coal the fastest-growing energy source from 2005 to 2030 on the back of rapid urbanisation and industrialisation in the region.

Coal projects continue to move forward. But with the utilisation of clean coal technologies, environmental controls are being seen in the region as an opportunity. China is in a unique position to be a frontrunner in low emissions coal technology and has been active in the field since the middle of the decade. Shanghai has operated one of China's most advanced supercritical plants for the past four years. Phase two of the Waigaoqiao power plant has a net efficiency of more than 42 percent, versus the worldwide average of 35 percent. It saves an annual one million tonnes of coal and reduces carbon dioxide emissions by 2.1 million tons in comparison with a typical Chinese power station of the same size.

Renewable energy sources--geothermal, solar, wind, tidal and wave energy--are currently growing faster than any other energy source at an average annual growth of 6.7 percent until 2030, according to the IEA. In ASEAN, the share of renewable energy in primary energy consumption is expected to grow annually at a rate of 9.1 percent to reach 185 Mtoe in 2030.

Smart energy economies are now a political imperative in Asia, but as Malaysia's Peter Chin noted, a commitment to renewables need not necessarily be anathema to the market. "Climate change-related business has a huge potential," he said. "The HSBC Global Research reports that the number of companies providing climate-related products and services has grown 140 percent since 2004 and produces US$530 billion in revenues worldwide, which is expected to touch US$2,000bn by 2020."

Asia's energy landscape for decades ahead looks set to rely on a mix of renewables and fossil fuel to power the engine of global growth.

Extract taken from a specially-commissioned Energy Book. You can download the pdf here

By : Peter Shadbolt, Financial Times Special Projects Contributing Editor