Photo credit: iStockphoto

The great earthquake and ensuing nuclear disaster have eventually become a "life changer" in various senses for the global LNG business, as well as for the Japanese people and industry. While the North American shale gas revolution has been labelled as a "game changer", the latest events have shown signs to bring about greater changes to the global LNG business. This report presents factors that could lead to significant changes in the LNG market in the medium and long term.

1. Short-term LNG procurement and supply activities

In the short term, incremental LNG to Japan is expected to come from suppliers in Qatar, Russia, and Indonesia among others, as well as fellow LNG buyers in Japan and other countries in the region.

The largest potential supply source is Qatar, which has recently completed its "mega" liquefaction trains. Qatar revealed in April that it agreed to supply additional 60 cargoes totalling 4 million tonnes over the next year1. Out of 16 million tonnes that is expected to be shipped out from Qatargas 3 and Qatargas 4 in 2011, up to 5 million tonnes is thought to be committed to China, with the rest, originally destined to the United States, divertible as flexible supply. Thus Qatar may be in a position to be able to provide more to Japan, if Japan makes additional requests and the two sides agree on pricing terms.

Indonesia is expected to provide additional LNG of 23 standard-size cargo equivalent from the Bontang liquefaction plant in East Kalimantan to Japan in 2011, out of 63 cargoes - 3.5 million tonnes--left available after the contract quantity was reduced under the sales deal with the Japanese western buyers2, with the remaining 40 cargoes destined to Korea.

After adding 10 cargoes from the Tangguh liquefaction plant in West Java, a total of 1.7-1.8 million tonnes of LNG is expected to be supplied from Indonesia to Japan in fiscal 20113.

Russian Prime Minister Vladimir Putin expressed his intention to support Japan by providing extra oil and LNG, immediately after the March quake. Although it is not yet clear how much additional LNG will be provided to Japan from the Sakhalin 2 project, so far at least 12 cargoes totalling 780,000 tonnes--three cargoes a month until June--are reportedly being supplied4. Mr Putin also floated an idea to increase LNG cargoes available to Japan from Europe by increasing Russian pipeline gas supply to Europe, although it would be very complicated and almost impossible to structure such transactions. On the other hand, when a non-Russian LNG cargo is diverted from an original destination in Europe to Japan, Russian pipeline gas supply to Europe may increase as a consequence.

Those LNG cargoes which were acquired as spare products in tenders earlier in 2011 by portfolio LNG players5 from the North West Shelf (NWS) and Darwin LNG projects in Australia couldeventually sold to Japan.

Other existing LNG suppliers to Japan are also expected to have incremental volumes to be offered, including 200,000 tonnes from Brunei and 1 million tonnes from Abu Dhabi.

Fellow LNG buyers have offered helping hands. Tokyo Gas, Osaka Gas, Chubu Electric Power, and Chugoku Electric Power, among others, have announced that they would provide LNG cargoes to Tokyo Electric Power Company (Tepco). Korea Gas Corporation (Kogas) also supplied six cargoes in March and April6 through a time-swap arrangement7.

Estimated spot LNG prices in North Asia have reportedly risen to US$13.5/MBtu as of the end of May from US$10 just before the earthquake in March8. Rather orderly purchasing activities have not so far initiated extreme price spikes, as buyers directly negotiate with existing suppliers and trading houses supplement with additional cargoes. Abundant LNG supply capacity that had already existed before the earthquake is helping buyers. Trading houses, which have played an important role in the current emergency situation, by expanding their leading positions in the market, are also expected to enhance their presence in structuring future long-term LNG transactions. In the end, there should be more then enough supply capacity in the short and medium terms to meet incremental LNG demand.

2. Activities looking ahead a few years, in the wake of changes in medium- and long-term demand outlook

A trend of expansion had already begun even before the great earthquake and the nuclear accident in March 2011, to increase LNG supply capacity for 2015 and thereafter and to increase LNG carrier ships. The trend has been accelerated since the earthquake to accommodate even greater demand for natural gas.

(1) Changes in the markets taking into account of shifts in power generation sources in Japan and other countries

More bullish, albeit cautious, views have been expressed on future increases of LNG demand in and outside Japan, as more new nuclear power projects may be halted, frozen or postponed everywhere.

The "glut" of supply in the international natural gas markets, which some industry observers mentioned before the earthquake, has not materialised and will not materialise in the LNG market. If some flexible LNG9 that is originally destined to the UK, or other European markets, is diverted to Asia, surplus in European gas supply may disappear sooner than previously anticipated to reduce the gap between oil-linked long-term contract gas prices and hub-traded prices, resulting in some changes in discussions of European gas pricing.

The trimmed forecasted nuclear power output is likely to result in clearer and greater anticipated LNG demand in the Asia-Pacific region. As buyers increase share of longer-term contracts in their LNG purchasing portfolio and reduce dependence on spot and short-term contracts, likelihood of short-term supply crunches will be smaller. At the same time, smaller spare production capacity resulted from larger contract commitments means a smaller supply buffer in the market.

LNG liquefaction projects in the Asia-Pacific region are expected to attract more attentions and gather momentum to move forward. The shifting perception on the market could function as a following wind for floating LNG (FLNG) plans that have emerged in recent years.

Buyers are now expected to seek contract extensions at the same volumes as they are currently entitled to take from existing projects so long as they can do so.

While some sellers may now have more bullish stances in long-term marketing talks, many LNG production projects are still competing for limited market windows. Those buyers with greater and more certain gas demand may have upper hands in long-term contract negotiations against sellers that have to line up stable outlets to realize projects happen.

(2) Developments in projects that are expected to come online in 2014-2015 and thereafter

Promoters of those LNG projects that have already made final investment decisions (FIDs) reiterate that they are proceeding as scheduled and want to be viewed as reliable suppliers. Those projects may face shortages of project engineering resources, including skilled labour sources by 2013-14 when construction activities are expected to peak. Some of the coalbed methane (CBM) based LNG projects in Queensland may share labour resources as the same engineering contractors are engaged in multiple projects. Recent developments of major proposed LNG production projects in line for near-future FIDs are described below.

The Chevron-led Wheatstone project's first two-train development with liquefaction capacity of 8.9 million tonnes per year in Western Australia, which was joined by Shell in April 2011, aims to make an FID in 2011. The site has room for additional three trains, when additional feedgas is secured, possibly from other third-party gas reserve holders. Tepco is likely to be a priority potential buyer for the output from them.

At the Pluto LNG project in Western Australia, where gas was already introduced to facilities and the first train of 4.3 million tonnes per year capacity is scheduled to ship out the first LNG cargo in September 2011, the operator Woodside now has a better prospect for the proposed second train expansion following the Martin-1 and Xeres-1 discoveries10.

Chevron reportedly hopes to start a front-end engineering and design (FEED) work on a fourth liquefaction train in 2012 and make an FID on the unit in 2013 at the Gorgon project in Western Australia, where exports are scheduled to start in 2014 from the first phase 15 million tonne per year, three-train facilities11. The company has made 10 discoveries in the past 18 months in the Greater Gorgon area.

The Australia Pacific LNG (APLNG) project, which is developed by Origin Energy and ConocoPhillips in Queensland, started ordering long-lead items in March 2011. In April Sinopec agreed to purchase 4.30 million tonnes per year and take a 15% equity stake in the project12. After the March earthquake in Japan, the negotiation process may have been accelerated to conclude the deal earlier. Talks with other buyers, including companies in Japan, are still reportedly underway.

These developments indicate that an FID on the first train of 4.5 million tonne per year capacity, or possibly two trains, may come soon to start operation in 2015.

The Arrow Energy LNG project, which is developed also in Queensland by Shell and PetroChina and supposedly planned for the Chinese market, is approaching a FEED phase. Shell made an FID on its Prelude floating LNG (FLNG) project offshore Western Australia in May 2011, as it previously indicated to do so13.

The 8.40 million tonne per year Ichthys project in Australia and the 2.50 million tonne per year Abadi project in Indonesia, both promoted by Inpex, again attract attentions as potential supply sources to the Japanese market. Inpex plans to make an FID by the end of 2011 to start production at Ichthys in 201614. A plan of development for the Abadi floating LNG production venture was approved by the Indonesian government in late 2010 15. In a renewed supply and demand environment, those projects may advance more quickly.

In Papua New Guinea, where the Papua New Guinea LNG (PNG LNG) project is under construction to start production in 2014, floating LNG production initiatives are emerging. In April 2011, a Norwegian floating LNG proponent Flex LNG agreed with upstream developers InterOil, Pacific LNG, and Liquid Niugini Gas, as well as Korean shipbuilder Samsung Heavy Industries (SHI) on deploying Flex's first 2 million tonne per year LNG Producer vessel to the Elk and Antelope fields16. The project also hopes to start production in 2014.

Talisman Energy is also mulls a 3 million tonne per year floating LNG production with Petromin, Höegh LNG, and Daewoo Shipbuilding and Marine Engineering (DSME)17.

Russia's Mr Putin instructed companies to provide additional LNG cargoes to Tepco, as well as to advance plans of a third liquefaction train at the Prigorodnoye plant of the Sakhalin 2 project to meet future gas demand in Japan18?

Western Canada's Kitimat LNG project partners Apache and EOG Resources were joined by Encana, the largest gas producer in Canada, to advance the project, after awarding a FEED contractto KBR in early March19. Apache is expected to remain as the operator and the majority shareholder of the venture. The partners hope to make an FID by the end of 2011 to start construction of the 5 million tonne per year first phase, leading to the first shipment in 2015. Encana has upstream partnerships with PetroChina and Kogas, who may become foundation customers of the Kitimat project.

Elsewhere in Canada's west coast, BC LNG Export Co-operative has applied an export license from the central government. Plans call for up to two liquefaction trains of 900,000 tonnes per year or a barge-mounted 700,000 tonne per year facility to realise small-scale LNG production as early as the beginning of 2014 to ship out an FOB cargo per month.

Shell reportedly mulls an LNG export project of 7.60 million tonnes per year at Prince Rupert Island on the west coast of Canada.

Japan Oil, Gas and Metals National Corporation (JOGMEC), Chubu Electric Power, Tokyo Gas and Osaka Gas have agreed to join Mitsubishi Corporation to develop the Cordova Embayment shale gas and other gas reserves in northeast British Columbia. The consortium plans to study the possibility of exporting the gas to Japan as LNG20.

More positive arguments are also being made on possible LNG exports from the United States since the March earthquake. The Sabine Pass liquefaction plan at the Louisiana LNG import site has already attracted preliminary capacity bookings of 9.80 million tonnes per year for the two-train and 7 million tonne per year facility plan21. While the Caribbean and other Atlantic region trading is expected to be the main target of the liquefaction project, it may extend market reach to Asia after improvements in maritime transportation routes, including the planned expansion of the Panama Canal in 2014. Similar export plans are progressing at the Freeport LNG terminal in Texas and the Lake Charles terminal in Louisiana.

In northern Russia, the Yamal LNG project was joined by Total with a 20% stake in early March 2011. Russian independent Novatek awarded a FEED work to CB&I, Chiyoda and Saipem in the same month22. The 16.50 million tonne per year project expects to make an FID in 2012 to start production in 2016.

The three project partners of the Shtokman project in northern Russia agreed on a technical solution for developing the field in April 201123. They hope to make an FID on both pipeline and LNG elements of the project in 2011.

Although the projects in Arctic north are thought to be less advantageous in marine transportation to supply to the Asia Pacific market than traditional suppliers in the region, they are being developed to potentially include the region as a regular market. They could supply to Asia mainly in summer through Northern Sea Route.

Also in April 2011, Norway's Snøhvit LNG project commissioned a pre-FEED study of a second liquefaction train to Foster Wheeler24.

Recent exploration successes in East African countries including Mozambique and Tanzania have raised hope to create a new LNG supply source there to the Pacific region.

On the west coast of Africa, a second train expansion is considered at EGLNG in Equatorial Guinea. The Brass LNG project in Nigeria wants to advance to an FID in autumn 2011 and start production in 2017. A new LNG project in Cameroon is planned to start a FEED work by the end of 2011. Although these West African projects do not necessarily target the Asia Pacific region as a primary target, some output may be provided Asia as flexible supply and increase availability to the global market as a whole.

Qatari officials have said that there is no Qatargas debottlenecking plans before 2015, eliminating any significant capacity additions beyond the planned 77 million tonnes per year in 2011.

Table 1: Recent developments in planned LNG production projects

(3) Revitalised LNG carrier ship ordering activities

Mitsubishi Heavy Industries (MHI) announced in early March 2011 that it was awarded by NYK Line a contract to build an eco-friendly (15% less fuel consuming) and standard-size (145,000 m3) LNG carrier ship25. The ship is believed to be used to transport LNG purchased by Tepco from Papua New Guinea.

Golar LNG placed a speculative order for six 160,000 m3 LNG carriers from Korea's Samsung Heavy Industries (SHI) in April 26 without any pre-arranged employment. The Norwegian shipowner is expected to arrange either time charter parties or shorter-term employment deals for the ships to be delivered in 2013 - 2014. SHI appears to have secured further two shipbuilding deals. Similarly in late March Maran Gas Maritime ordered a 155,900 m3 LNG carrier from DSME, also without a specific shipping engagement.

In early April, Höegh LNG issued a firm letter of intent (LOI) to Hyundai Heavy Industries (HHI) for the delivery of two 170,000 m3 Floating Storage and Regasification Units (FSRUs) with options for four additional vessels27. The first two units are scheduled to be delivered in 2013-2014. They have been ordered for potential use at floating LNG receiving terminals planned and proposed around the world, including those in developing countries.

Qatar's Nakilat is also reportedly quoting new building prices, which is aimed at comparing economics of chartering existing standard-size vessels and building brand-new ones.

3. Plans to increase procurement LNG

(including plans before the disaster)

(1) LNG thermal power plants

According to the electric power supply plans of utility companies, nine electric power companies, except for Chugoku Electric Power, plan to construct new LNG thermal power plants, with expected total power generation capacity of 16,251 MW. Furthermore, after the disaster, Tepco plans to install 1,449 MW LNG-fuelled power plant for emergency to secure electricity supply in the sites of the existing plants. As a result, the generation capacity installed would amount to 17,700 MW, possibly leading to an increase in LNG of 9 million tonnes per year. Moreover, the rising utilization rates of the existing LNG thermal power plants, including those owned by IPPs28/PPSs29, also would lead to an increase of LNG demand.

Table 2: Construction plans for LNG thermal power plant

(2) LNG receiving terminals and the shift to natural gas in the demand/consumption side

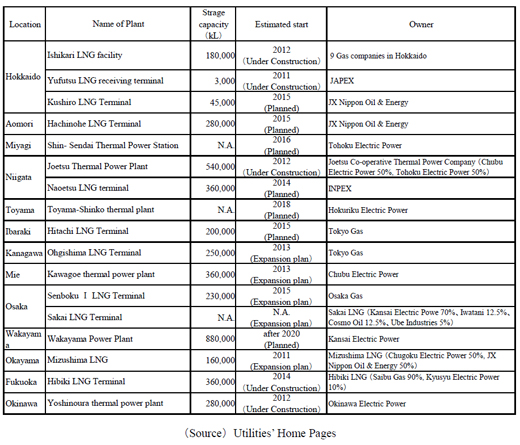

As construction and expansion of LNG thermal power plants and the shift to natural gas in the industrial sector are being accelerated, many new LNG receiving terminals and expansions of existing ones are planned (Table 3).

In the city gas sector, concern over power supply shortage and looming possibility of rolling blackouts, caused by the loss of large-scale power generation capacity after the earthquake, would increase the necessity to decentralize power generation systems, possibly accompanied by smart energy networks. Diffusion of gas cogeneration and gas air-conditioning (GHP30 and absorption type) is expected to accelerate, increasing natural gas demand even further.

The Strategic Energy Plan31 of the Japanese government stated even before the earthquake that the gas cogeneration is a significant measure to achieve the low carbon society, with its advantages of energy savings and low CO2 emissions.

After the disaster, the gas cogeneration, as a decentralized power system, would play a more important role in terms of the supplementation with the supply of a large-scale centralized power plants and the electric-load levelling. If the installed capacity32 of gas cogeneration reaches the 8,000 MW target in the Strategic Energy Plan, its consumption amount, the expected total LNG demand would be 2.9 million tonnes per year33.

The gas air conditioning system helps mitigate the peak electricity demand in summer34. GHP, in particular, is effective, as its power consumption is one tenth35 of its electric power counterpart. Therefore, it is expected that the installation of the gas air conditioning system would be accelerated. Assuming that the introduction pace increases to twice that of the past decade performance, the additional capacity would lead to an incremental demand of 100,000 tonnes per year36

However, in case the gas air conditioning replaces some electricity generated by LNG thermal power plants, and natural gas consumption is reduced by the waste heat from the gas cogeneration, the increase of LNG demand in the city gas sector would be offset by reduction of LNG demand in thermal power generation.

Table 3: Construction plans for LNG receiving terminal

(3) Operation status and construction project of nuclear power plant

As of the end of May, 19 nuclear power plants (installed capacity 17.580GW) of total 54 existing plants are operating (Table 4). Immediately after the earthquake, 26 nuclear power plants (installed capacity 24.442 GW) were operating. Since the Fukushima accident, the Hamaoka nuclear power plant (Units 4 and 5) stopped operations at the Japanese government's request and five reactors were shutdown due to periodical inspections37 and other causes. The operating plants are due to shutdown one by one for periodical inspections. The extension of inspection period is to cope with various additional checks that were resulted from the disaster. Utilisation rates of the nuclear plants are expected to fall in general. Decommission of Fukushima Daiichi (I) units 1-4 (total installed capacity 2,812MW) was determined and Fukushima I units 5 and 6 (total installed capacity 1,884MW) and Fukushima Daini (II) (total installed capacity 4,400MW) are to lose 9,096 MW generation capacity for the time being. It is expected that LNG thermal power plants have a role partially to cover electricity shortages in such a situation, and LNG demand would rise.

Table 4: Status of nuclear power plants

Table 5: Status of nuclear power plants (under construction, planned)

4. LNG business activities will be affected by possible Tepco restructuring

Tepco has always assumed a central role in the LNG business for decades as the largest private-sector LNG buyer in the world with annual purchase of 20 million tonnes, diversified LNG supply sources, some LNG carrier ships, and existing and planned equity participation in two LNG production projects from where it purchases output38.

Tepco has also been active in expanding its presence in wholesale and large-customer retail gas business in Japan, by starting tank-truck LNG delivery from its Futtsu LNG terminal in September 2007 and signing a heads of agreement (HOA) in June 2010 with Shizuoka Gas on LNG sales to the company.

Although Tepco is shaken by the nuclear crisis, its LNG business is still world-class and continues having significant influence over the entire Asia-Pacific regional market, to say nothing of its own electric power supply area and other LNG user companies in the country.

As international business of Tepco, including investment in LNG production projects, may be restructured in the course of the company's business streamlining and reorganising process, it will be even more important for Japanese players, including Tepco, to structure their proactive involvement in LNG procurement process and value chains as a whole in a manner that enhances security of energy supply.

This article was reproduced with permission fromThe Institute of Energy Economics, Japan. Hiroshi Hashimoto and Akihiro Shimao are Senior Researchers for the Gas Group, Strategy and Industry, IEEJ.

By : Hiroshi Hashimoto and Akihiro Shimao, IEEJ