Mr Nathaniel Bullard is Director of images/default-source/content at Bloomberg New Energy Finance, the clean energy and carbon markets analysis group of Bloomberg LP. In his role he oversees analytical engagements across sectors in clean energy, as well as the group's executive engagements through its Leadership Forum Series and yearly Summit. He is also a contributor to Bloomberg's cross-platform initiatives to analyse mergers and acquisitions, and environmental, social and governance data.

Bloomberg New Energy Finance--the clean energy and carbon markets analysis group of Bloomberg LP--explains how clean energy investment survived the financial crisis to storm to new heights in 2010.

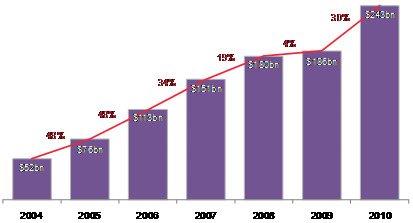

Clean energy investment has seen incredible growth since the middle of the last decade, from just over US$50 billion in 2004 to nearly a quarter of a trillion dollars in 2010. Few, if any, sectors can point to such a robust and broadly-based growth during a tumultuous time in the world economy.

Look at the numbers: Clean energy has not had a down year since the creation of major market support programmes in Germany, which began in 2004. The growth rate was nearly 50 percent in 2005 and 2006, and even remained high--19 percent--during the first year of the financial crisis (and had the crisis not occurred in 2008, the rate would have been much higher). In fact, the only year of low growth was in 2009, during the depths of the economic downturn.

The big question now is whether this healthy growth will continue. As any sector or company expands, it begins to encounter the 'law of large numbers'--it becomes more and more difficult to sustain high rates of growth because the absolute numbers required to maintain any fixed rate continue to rise as well.

Global total new investment in clean energy 2004-10 ($BN)

Note: Includes corporate and government R&D, and small distributed capacity. Adjusted for re-invested equity. Does not include proceeds from acquisition transactions.

BY: Nathaniel Bullard, Bloomberg New Energy Finance