Michel Di Capua is Head of US Analysis for Bloomberg New Energy Finance, based in New York City. In his current capacity he oversees an analyst team focused on research and analysis into clean energy. This includes the production of in-depth reports and development of dedicated carbon, REC, and renewable energy forecasting models. Mr Di capua's previous professional experience included solar energy project development with Tata Power in India and strategy consulting for the telecom industry.

In our earlier discussion, we covered the importance of government policy in promoting investment in clean energy in Asia. But that's not the only driver: Motivated by corporate sustainability efforts, some of the world's biggest companies have also begun to buy clean energy to power their facilities and cut their environmental footprint.

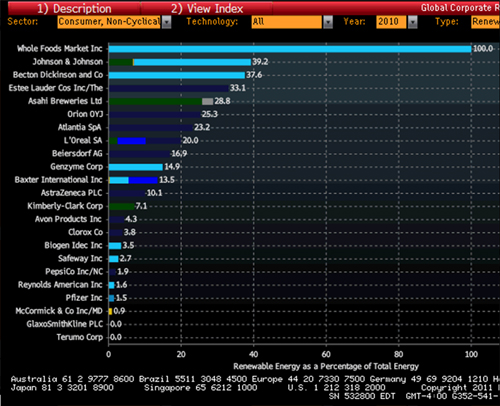

This brings us to the CREX--the Corporate Renewable Energy Index--which ranks companies according to their voluntary renewable energy procurement over the last two years. Created by Bloomberg New Energy Finance and Vestas Wind Systems and launched in June 2011, CREX is based on responses to a survey of the world's 1,000 largest companies by market capitalisation. This study was the largest and most global ever conducted to track corporate renewable procurement.

What the findings tell

Top of the list--i.e. the companies with the largest share (in percentage terms) of renewable electricity procurement in their respective sectors--were: Plum Creek Timber (basic materials); News Corp (communications); Kohl's Corporation (consumer goods); CLP Holdings (energy and utilities); Toronto-Dominion Bank (financial services); Vestas (industrial); and Adobe Systems (technology).

The voluntary purchase of renewable energy is on the rise, but for most companies it meets only a small share of their total electricity needs. In our findings, some 8 percent of respondents' power consumption came from renewable sources in 2009 and 12 percent in 2010. Around a third of companies that bought renewable electricity didn't know which technology it came from (wind, solar, biomass, etc.). Of those that did, wind was by far the top choice at 51 percent.

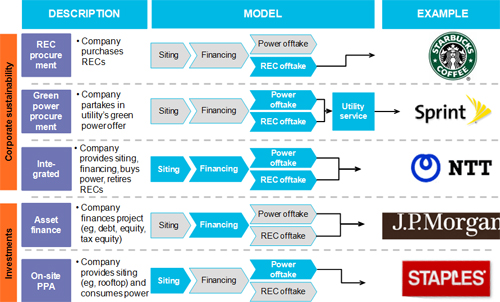

Based on the survey results (see diagram), the most common way to procure renewable energy was through renewable electricity certificates (RECs). They are generally in sufficient supply and available at reasonable prices.

Contracting renewable power through a green pricing programme offered by a utility was the second-most popular method. But only a small amount was purchased from projects that were directly financed by the company. Direct project finance is relatively time-intensive and costly when compared with other forms of renewable energy procurement.

More models to emerge

More models will undoubtedly emerge. Corporations will become not only more avid, but also more discerning, procurers of renewable energy. Many will tend towards more "direct" investment--for example, by moving from a model that involves purchase of RECs from third-party brokers to undertaking their own financing of the renewable project and retaining the associated environmental attributes. Already, we are beginning to see this trend unfold.

The survey was primarily interested in corporate action that went beyond policy mandates. As a result, the rankings captured only renewable energy investments for which the environmental attributes were sold and retired (by any means). Often, companies make such investments as part of their corporate sustainability strategy, although they may also be driven by cost.

We did not include investments that companies made as part of their normal business activities. For example, we excluded a bank's investment in a renewable project if the environmental attributes (e.g. the RECs) are sold to another entity and the sole purpose of the investment is gaining a good rate of return.

Corporate participation in renewable energy: Business model options

Source: Bloomberg New Energy Finance

Figure 1: Tracking the 'CREX' on the Bloomberg terminal

Source: Bloomberg, Bloomberg New Energy Finance

For the next few weeks till SIEW 2011, Knowledge Partner Bloomberg New Energy Finance will run a special series of opinion editorials on SIEW, where its lead analysts will bring insights pertinent to clean energy in Singapore and Asia.

BY: Michel Di Capua, Bloomberg New Energy Finance