(Photo credit: iStockphotos.com)

Japan's LNG import increased significantly to 78.5 million tonnes in 2011 from 69.2 million tonnes in 2010, reflecting continual shut downs of nuclear power plants one after another following the Great East Japan Earthquake of March 2011. In addition to the 13.5 percent increase in the import quantity, soaring LNG prices have boosted the monetary amount of LNG imports further.

Japanese payment for LNG import increased by 37.5 percent to 4.8 trillion yen in 2011 from 3.5 trillion yen in 2010, or 52.0 percent in US dollar terms to US$60.0 billion from US$39.5 billion. In particular, sharp increases were seen in the third and fourth quarters of 2011.

Although this increase was partially offset by appreciation of the yen, Japan's LNG import amount seems to have exceeded 1 percent of the GDP for the first time in history.

In 2011, the world LNG trade amounted to about 240 million tonnes, up 8 percent year-on-year. On the demand side, LNG imports surged in Japan following the Great Earthquake, and also in other booming Asian countries. On the supply side, exports from Qatar shot up significantly as its large-scale plants went on stream in sequence, , delivering nearly 12 million tonnes to Japan (up 4 million tonnes from the previous year) to account for the largest portion of the increase in Japan's LNG imports.

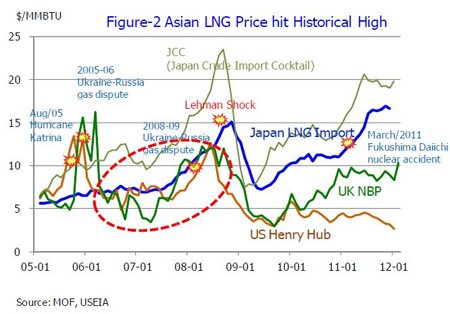

Japan also increased its imports from the Atlantic region, including West African countries, to 4.7 million tonnes in 2011 from 3 million tonnes in 2010. By a closer look on the world gas markets, extremely high prices of LNG destined for Asia stand out.

In Europe, LNG imports from the Middle East and Africa are on the rise, along with reinforced natural gas import from Russia after completion of the Nord Stream pipeline, driving the market toward decoupling of gas and oil prices. Natural gas supply to Europe is expected to remain stable for some time to come.

Meanwhile, LNG prices for Japan on long-term contracts are mostly linked to crude oil prices.

Thus, LNG prices delivered into Japan, on a million-BTU basis, stood at about 90 percent (an average of 91 percent between 2000 and 2005) of the Japan Crude Cocktail (JCC; the average crude oil import price CIF Japan) in the first part of the 2000s. However, as crude oil prices spiked, the price ratio had decreased to 55 percent just before the Lehman Shock suggesting a decoupling phenomenon from oil prices.

Thereafter, however, the ratio recovered to 69.5 percent in March 2011 just before the Great Earthquake, and even to 83.8 percent in December 2011. As crude oil prices continued to rise during the same period; crude oil and LNG import prices in December 2011 were up 11 percent and 33 percent, respectively, from the March levels. As large nuclear power plants were running as the base load electricity supplier at high operating rates before the Great Earthquake, their sweeping shut-downs caused a dramatic increase in LNG imports to Japan.

Considerable pressure

Such a significant amount of the Asian premium on LNG is putting considerable pressure not only on Japan but also on other Asian countries importing LNG from the same sources. If the nuclear power plants continue to sit idle for the rest of this year while the yen depreciates as observed recently, the value of Japan's LNG imports would shoot up from 3.5 trillion yen in 2010 to more than 6.5 trillion yen in 2012, exceeding the previous estimate by IEEJ by 1 trillion yen or more.

In January 2012, Japan's trade deficit hit a record 1.48 trillion yen, no small part of which was owing to imports of LNG and other energy commodities. Such situations will inevitably result in huge hikes in electricity and city gas tariffs, dealing a serious blow to the Japanese economy as well as to the development of the LNG market in Asia.

A mid- to long-term outlook

Given the circumstances discussed above, Mr Hiroshi Hashimoto, Senior Analyst at IEEJ, analyses the mid- to long-term outlook of the world LNG market as follows:

1) Between now and through 2015, several Southeast Asian countries will emerge as new LNG importers, while LNG demand in the existing markets will increase steadily.

On the supply side, however, only a small number of new projects are coming on line; these are the Pluto LNG project in West Australia (starting up in 2012), the Angolan LNG project (2012), and the Algerian LNG project (2012–2013). Consequently, it is widely viewed that the world LNG market will tighten up.

However, there will be uncertainties to work either as plus or minus factors, such as the prevailing European economic crisis, to cause a sluggish energy demand, or prolonged shutdowns of nuclear power plants in Japan to keep its LNG demand high.

2) Final investment decisions (FIDs) were made in 2011 for several LNG plants in the Pacific basin scheduled to go on stream in 2015 or later. These projects, if commissioned without delay, would contribute to stabilise the LNG market in the long run. The overall LNG production capacity of Australia--including the Ichthys LNG project, which was given the green light in early 2012--will exceed 80 million tonnes a year around 2018, making the country the largest LNG exporter in the world.

The Ichthys LNG project, to be operated by INPEX with its primary export destination being Japan, is considered virtually a Japan-madeproject. As some of the Japanese buyers have formed a consortium for joint purchasing, it could provide a model case for structuring future purchasing strategies. In addition, new prospective supply sources are coming up in East African countries like Mozambique.

The US impact

At the same time, LNG export from North America is emerging rapidly as a next-generation supply source. The Sabine Pass project, which has recently fixed sales agreements for 16 million tonnes, uses low-cost gas brought about by the shale gas revolution. Its cost is estimated to be about 30 percent to 40 percent lower than the LNG procurement cost of Japan.

Other LNG projects coming up in North America, if materialised as proposed, could have a sizeable impact on the LNG pricing system in the Asia-Pacific region.

To date, Japan has been working on energy security concentrating on ensuring supply of oil and stabilising its price. However, following the Great East Japan Earthquake, unexpected problems have surfaced such as shutdowns of nuclear power plants and the huge Asian premium on LNG prices. This made it necessary to rebuild Japanese energy policy carefully re-examining what measures are practicable, feasible and effective.

Nuclear option is now diminishing and can no longer be considered as the single central pillar, while renewable energy could not be a leading player. On balance, no special measures appear available other than those adopted during the oil crises in the 1970s. For example, if Japan had 170 days (as is the case for oil) equivalent or 30 million tonnes of LNG stockpiling, Japan, even facing the earthquake-led crisis, would not have rushed to take up every spot cargo available in the market.

As LNG prices have soared significantly, relative costs of stockpiling facilities or long-haul transport are now lower compared to the value of LNG itself. Thus, stockpiling and supply diversification of LNG have become realistic options in considering energy security. Also possible as options are construction of domestic trunk gas pipelines as well as piped natural gas import from Russia, though substantial reform of the Japanese gas and electricity industries is needed to "bundle" the wholesalers and independent gas buyers as a prerequisite.

In this regard, particular attention will need to be paid to the development of Japan-Russia relations in the era of Putin's new administration.

BY: Hiroshi Hashimoto, Institute of Energy Economics, Japan (IEEJ)