Southeast Asia is an obvious candidate for the creation of a strongly-integrated regional power grid. First, sustained rapid economic growth is encouraging investment in power generation, transmission and distribution in all markets. Second, most governments in the region are committed to closer economic integration and agree that power sector integration should be used to spearhead the process.

Despite numerous environmental obstacles, a string of new large hydro projects are being developed in remote parts of the Mekong watershed that require the construction of new high capacity transmission lines. Relatively cheap natural gas and coal is being used to fuel the growing stock of thermal generating capacity. Once the booming wind and solar power sectors are thrown into the mix, it is clear that Southeast Asia possesses a varied generation portfolio, but only when viewed on a regional basis. Laos, for example, has vast-hydro capacity but a limited market, while investment in renewables is concentrated in just two countries--Vietnam and Thailand.

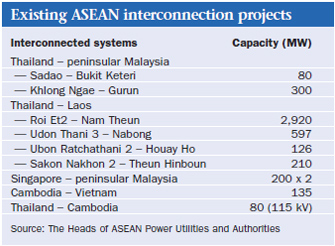

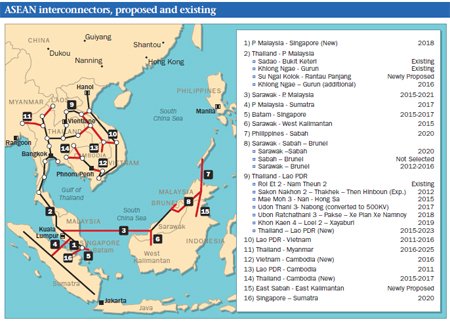

Cross-border integration is clearly the best strategy to offset the weaknesses of national grids, but regional jealousies, the economics of individual projects and environmental difficulties have conspired to make progress slower than many anticipated. Nevertheless, there are already some high capacity cross-border interconnectors in place in the region, including the 2,920 MW Roi Et2-Nam Theun link. A further 13 interconnectors involving at least two countries are due to be developed over the next decade, often in conjunction with new large hydro schemes.

If developed as planned, they will collectively provide cross-border transmission capacity of 19.5GW, which the Heads of ASEAN Power Utilities and Authorities estimates will save US$788 million a year, based on 2009 prices. In January this year, a separate report by the government of Thailand estimated regional savings on power generation and reduced energy imports at US$1.87 billion a year. It concluded that the 2020 deadline for the completion of the regional grid was likely to be achieved, although it conceded that different speeds of development in different countries is holding up the process.

Grid integration is one of the main aims under the ASEAN 2010-15 Plan of Actions for Energy Cooperation. Development is likely to be most rapid in mainland ASEAN states. At a conference in November last year, a spokesperson for the Prime Minister of Singapore said that the concept of an ASEAN-wide grid was "quite overwhelming and daunting", but added that "as a connection between geographically contiguous ASEAN member states in order to serve each other's needs, then the logic is quite compelling".

In the longer term, a much larger East Asian power grid has been proposed, which would include China, Japan, India and Russia, as well as the ASEAN states. Only much greater regional dependence on renewables is likely to provide the motivation for such a project, but Beijing and Tokyo have both backed the scheme because of its ability to provide some insurance against a natural disaster, along the lines of the Fukushima earthquake. The Indian government too has become more interested in the idea as a result of the July power crisis in India. However, for the purposes of national energy strategy, such a vision remains in the realms of a vague aspiration rather than a concrete proposal.

Suppliers and markets

The power supply situation varies massively across the region, but current trends seem likely to continue. Laos, which is already an important net exporter, is expected to become an even more important regional power supplier over the next few years. Thailand and Cambodia are already both net importers, and are expected to be joined by Vietnam as early as 2015.

Myanmar is the great unknown quantity: It has the greatest potential for growth in generating capacity, but also most untapped domestic demand. On the generation front, the pendulum has begun to swing back from thermal to hydro. Many coal and gas-fired power plants have been erected in coastal areas over the past decade, but enthusiasm for lower cost hydroelectricity is returning, as large hydro becomes more acceptable in the face of global warming.

Myanmar is developing massive hydro capacity and it is now more politically acceptable for the rest of the region to import electricity from the country. On the other hand, the government of Myanmar is finally listening to protests over the lack of domestic power supplies and over the environmental impact of some dam projects. Electricity is a political issue in Myanmar: power rationing often triggers street protests, while Shan rebel groups target power sector infrastructure for many of their attacks.

Even during the past five years of high political tension, the generating capacity of Myanmar has increased by an average of 10 percent a year. However, installed capacity still stands at just 2,254MW, a very low figure in comparison with its population of 48 million. Estimates vary, but most sources agree that demand for electricity has grown at a faster rate than supply and only about 13-25 percent of the population has electricity at home. As a result, many businesses rely on private generators.

The minister for industry, Soe Thane, has promised an electrification campaign. Any new gas exploration licences will include a stipulation that a minimum proportion of all gas production must be sold within Myanmar, while Thai firm PTT Exploration and Production (PTTEP) may be encouraged to divert much of the 1,100 million cu ft/day that it exports from Myanmar to Thailand to local consumers. PTTEP is expected to produce 300MMcf/d on its new Zaqtika Field in Myanmar next year, of which at least 60MMcf/d will be marketed in Myanmar. Thane said: "There is an urgent need to build at least two plants around Yangon, and maybe one around Mandalay."

Gas-fired plants currently account for just 350MW of national generating capacity, in comparison with 1,270MW of hydro capacity. The government's current power sector strategy is to develop new hydro schemes for export and new gas-fired capacity for domestic supply. Yet transmission investment remains at least as much of a priority, with 8,000km of new 230kV considered essential by energy ministry officials. The ministry reports that the sector will require investment of

US$26 billion over the next decade, but this will only be secured with massive foreign investment. The Electricity Generating Authority of Thailand (Egat) has promised to support Myanmar in transforming its power sector, but it remains to be seen what form this support will take.

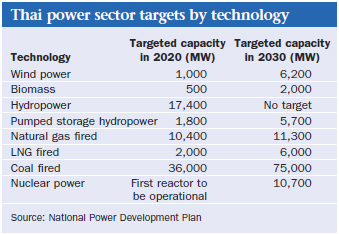

Thailand boasts the most developed power sector in the region, but the government fears that political and economic liberalisation in Myanmar could have profound implications for its own energy security. Thailand currently sources 70 percent of its electricity from gas-fired power plants and much of that gas comes from Myanmar. New gas-fired plants in Myanmar could see supplies to Thailand cut or at least stagnate.

While power consumption is growing by about 5 percent a year in Thailand, Vietnam leads the way with an average increase of 14.4 percent a year over the past four years. This has just outpaced generating capacity, which grew by an annual average of 13.7 percent over the same period. Most investment has been made in thermal generating capacity, creating a generation mix of 44 percent gas-fired plants, 27 percent coal, 27 percent hydro and 2 percent oil in 2011, although renewables are expected to register 2 percent by end-2012. The country is being transformed from a net coal exporter to net importer in the process and imports are expected to reach 10 million mt/year by 2015.

Hydro revival

As in much of the region, the focus in Vietnam is turning back to large hydro. The nuclear ambitions of Vietnam and other countries in the region had re-emerged in recent years, but the Fukushima disaster appears to have put paid to the development of any commercial nuclear reactors. In any case, any reactor would take more than a decade to come on stream and so would not play a role in medium-term power supply planning.

In March, the first phase of the 340MW Dong Nai 4 scheme was completed in Lam Dong Province. State-owned Electricity of Vietnam (EVN) hopes to bring Dong Nai 4 fully on stream by the end of this year. In addition, the design of the 1.2GW Lao Chau scheme on the Da River was completed in May by Russian firm Institut Hydroproject. The government has decided to proceed with development, but is currently considering whether to offer a competitive tender for the venture's engineering, procurement and construction contract.

In February, the Asian Development Bank announced that it would provide loans to the government of Vietnam totalling US$730 million to help fund transmission projects over the next eight years. This ADB support should also help the government and EVN to attract funding from other multilateral agencies.

While most governments are seeking to develop a diverse generation mix, many analysts argue that the government of Cambodia is putting all of its eggs in one basket. Local businessman Ly Yong Phat and Thailand's Ratchaburi Electricity Generating Holding have created a joint venture called KK Power to develop a 1.8GW coal-fired power plant in Koh Kong Province at a cost of US$3 billion. This compares to current installed capacity of 716MW. Just 10 percent of the new project's output will be supplied to Cambodian consumers, with the remaining 90 percent exported to Thailand. KK Power is currently negotiating a tariff agreement with the Cambodian government.

However, investment in Cambodia's hydro sector is increasing. The country has limited proven energy resources in comparison with neighbouring states and is already forced to rely on power imports. It has therefore welcomed direct investment by Chinese firms and a series of concessional loans from Beijing. Five hydro schemes that are being developed by Chinese companies are due to come on stream by 2015. The first, the 193 MW Kamchay project southwest of the capital, was completed by Sino Hydro in December.

Beijing has also provided much needed support for downstream developments, including most recently a US$53 million loan to develop several transmission lines. The most important of these will connect four eastern provinces to the national grid and is being developed by china National Heavy Machinery Corporation. In June, Cambodia's minister of industry, mines and energy, Suy Sem, said: "The project will provide large economic advantages to people in those provinces when it is completed. On behalf of the government of Cambodia and myself, I'd like to profoundly thank China for its aid on the right target and right time to develop Cambodia's energy sector." As might be expected, Chinese financial support is greatest where it has the strongest political ties. Cambodia and Myanmar are the most favoured markets, followed by Laos.

Many commentators have described Laos as the battery of Southeast Asia, not just because of its vast hydro potential but because limited domestic demand means that it is able to export almost all of the electricity that it produces. The region's dash to develop as much hydro capacity as possible appeared to have been halted last year. Cambodia and Vietnam both complained that the 1,285MW Xayaburi hydro scheme in Laos would affect the flow of water on the main course of the Mekong and therefore also fishing, water supplies and particularly rice cultivation in both countries. The appeals from Phnom Penh seemed to have halted work on Xayaburi.

The general view in the region's press has been that construction work on Xayaburi would be suspended until an independent report on the scheme had been completed but comments by Laotian ministers over the future of the project contradicted each other. By this July, various environmental non-governmental organizations were insisting that the project site on the Mekong had already been deepened and widened. The Mekong River Commission confirmed this when it revealed that the project was "in an advanced preparation stage with…exploratory excavation in and around the river completed."

Finally, in mid-August, Thai firm Ch Karnchang Public Company admitted that it had resumed work on the venture. The company's chief executive, Plew Trivisvavet, said: "We are still working on the project. We haven't received a formal letter from the Lao government that we should suspend or put the project on hold. We have entered the area for some relocation work and to prepare for the construction of the reservoir."

The venture is being developed under a 29-year operating contract by Xayaburi Power Company, which in turn is owned by a consortium of Ch Karnchang Public Company (57.5 percent), Natee Synergy Co (25 percent), Egat (12.5 percent) and Bangkok Expressway (7.5 percent). First electricity from the scheme is due in 2019 and almost all power produced on Xayaburi is to be exported to Thailand. Although environmentalists have complained about overdamming on the Mekong for many years, Xayaburi would be the first dam built on the main stretch of the Mekong itself, rather than on tributaries, although other such schemes have been planned.

The MRC, which oversees hydro developments in the four lower riparian states, estimates that the eleven planned new dams on the river will reduce the value of agricultural production in Cambodia and south Vietnam by more than US$500 million a year. Water resource disputes are further complicated by maritime boundary conflicts and the Thai-Cambodian spat over the sovereignty of land around the Preah Vihear temple.

Common goals

Despite their very varied positions, the power policies of the various Southeast Asian states are moving together. To meet rapidly growing demand for electricity, most governments are seeking to create a more liberal investment regime. The government of Vietnam, for example, has pledged to phase out generation subsidies by 2015, with downstream eregulation to follow. Such reform will weaken the dominance of EVN, although existing subsidies are forcing EVN to operate at a loss.

The removal of state controls on Vietnamese electricity prices will allow power tariffs to increase, encouraging investment in the country's growing renewable industry. The government has set a target of increasing the proportion of renewables in the generation mix to 4.5 percent by 2020. The first phase of Cong Ly Construction andTrading Company's99.2MW wind scheme off the coast of Bac Lieu Province, has been developed using GE turbines. The same two firms have also agreed terms for a larger, 200MW, wind farm off the coast of Can Gio. Until now, Vietnamese wind power projects have been much smaller and entirely onshore. The government unveiled its renewable energy plans in its 2012-2030 National Power Development Plan, but has already suggested that its wind power targets should be increased.

Such a substantial role for renewables should certainly encourage greater power sector integration in the region, in order to even out fluctuations in weather dependent generation. Yet it is hydro that remains the cornerstone of regional plans. As ever, the ADB is keen to champion energy sector cooperation in the Greater Mekong region. It has identified Laos, Myanmar and Yunnan Province in China as the main sources of supply and in all three cases, hydro is the great attraction. Much will depend on how well upstream and downstream riparian states are able to work together, but the benefits of greater cooperation are plain to see.

BY: Neil Ford, Platts Energy Economist