The large-scale LNG carrier market appears to have reached saturation – at least in the short term – but the less developed small-scale market still represents plenty of opportunities. Wärtsilä examines when and under what circumstances it makes most sense to use a smaller gas carrier.

In spite of the severe impact of the recent collapse in energy prices, the long-term outlook for small-scale LNG shipping and bunkering remains positive. While operators may be hesitant to make major investments in large-scale vessels and terminals at the present time, Alexandre Eykerman, Director of Sales at Wärtsilä Marine Solutions, argues that small-scale LNG represents a less risky, more flexible alternative, and, perhaps most crucially, a market that is still growing.

“We’re entering the gas age, of that there is no longer any doubt,” he confirms. “What remains to be seen is how we will resolve the problems of supply and distribution.”

Eykerman explains that the infrastructure for distributing LNG is still limited, with existing LNG volumes mainly being traded towards large terminals, which, in turn, are linked to large utilities. These projects typically come with long-term contracts, which ensure the viability of the investment.

Small-scale terminals in demand

However, there is also a strong business case for smaller-scale LNG terminals. The rationale for building a terminal of this kind may vary, from a lack of space to a limited energy demand or challenging geography. In restricted areas, such as islands in Indonesia or the Caribbean, for example, it is common to use small-scale LNG infrastructure to supply energy to remote or isolated regions. Where it is not feasible to build a pipeline, it often makes sense to install small- or medium-scale LNG instead.

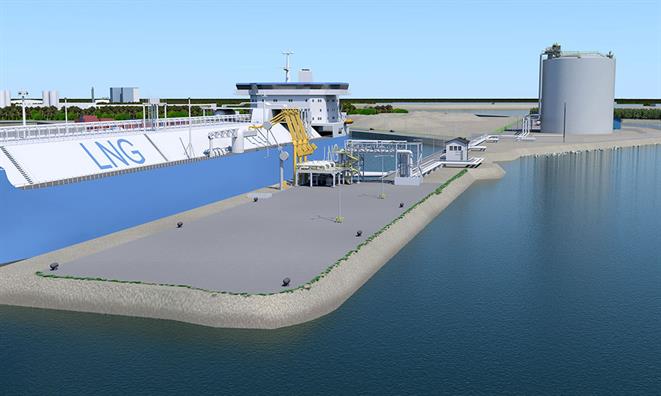

One such example is Tornio terminal in Finland, which is under development and due to be up and running in early 2018. Wärtsilä has delivered a complete turnkey solution for the terminal, which will be the largest of its kind in the Nordic region. Providing a full range of LNG services, including storage in a 50,000 m3 tank, regasification, pipeline distribution, ship bunkering, transshipment and loading for redistribution, the Tornio terminal will supply LNG to customers in the mining, steelmaking and shipping industries in northern Sweden and Finland.

Small-scale offers speed

Whereas a large-scale LNG plant may take up to 10 years to develop, a small- or medium-scale plant can be constructed in one to four years. Requiring significantly smaller capital investments, smaller-scale plants sometimes offer a more economically viable solution than their large-scale counterparts. Smaller satellite terminals also have an important part to play in the overall LNG infrastructure, providing energy to communities or fuel to local industries.

“So far, the investment costs associated with LNG projects have typically kept receiving terminals relatively large and thus unsuitable for a ‘single gas consumer’ philosophy,” says Eykerman. “However, we’re now seeing more small- and medium-scale LNG activity, with a growing number of regional storage hubs, from which gas is supplied by tanker or truck directly to the end user. The capacity of these storage facilities typically ranges from a couple of hundred m3 to 20,000 m3.”

As the number of these satellite terminals continues to grow, the need for small-scale LNG carriers will increase. Whereas large-scale terminals can receive large-scale carriers, one of the main limitations of a small-scale terminal is the kind of vessel it can accommodate.

Size limit

“Limitations may be related to the length of the ship or the depth of its draft,” notes Eykerman, adding that most small- to medium-sized terminals cannot accommodate vessels longer than about 150 metres. However, there is no minimum size restriction to prevent smaller ships from calling at larger terminals.

“Moreover, it would make no sense for a giant tanker to call at a terminal that only needs 10,000 m3 of LNG, when it could unload 200,000 m3 elsewhere,” he says. “With the abundance of LNG cargo that’s globally available today, the trading of smaller volumes will increase – as will the number of small-scale ships – as opposed to what we’ve seen up to now, with only very large quantities being transported.”

The small-scale LNG carrier market is growing. Eykerman estimates that there are currently some 35 to 40 vessels in the 0–50,000 m3 range that are dedicated to the small-scale LNG business – plus a small number of bunkering barges – and that these have all been custom-built for a specific project.

Eight multigas carriers

For example, one of the most recent examples of a newbuilding of small-scale carriers is Evergas’ “Dragon Class” range of eight 27,500 m3 multigas carrier vessels. These ships have been specifically designed to fulfil a 15-year contract with Ineos to transport ethane from the Charlotte terminal in North Carolina to Europe.

“Nobody is building small-scale carriers speculatively,” says Eykerman, explaining that tank size, draft and length are all being custom-made for the trade route, because the market has not yet agreed on an optimum small-scale carrier size.

“However, looking at the terminals that exist – both on the supply and receiving ends – I think it’s clear that there’s a market for vessels with a tank of around 20,000 m3 and a length of no more than 150 metres. These ships would be able to call at Charlotte, Tornio and most other terminals of this kind and would have the flexibility to be deployed wherever there’s a need,” he continues.

“Moreover, Wärtsilä specialises in turnkey LNG solutions, which means that we can deliver whatever solution is needed – from cargo handling to reliquefaction, regasification and pump systems – on a case-by-case basis, regardless of size or capacity.”

This article was first published on Twentyfour7, Wärtsilä’s stakeholder magazine.

By :Wärtsilä