Among fuel oils, demand for diesel oil is the third largest after gasoline and naphtha; it is consumed in a wide range of fields. Diesel oil is also the only major fuel oil that increased in consumption compared to FY2010, the year before the Great East Japan Earthquake. It is now declining through FY2018 but at more moderate pace compared to other fuel oils (FY2017: -0.6%, FY2018: -0.6%). The share of diesel oil in total fuel oil sales expands from 16.8% in FY2010 to 19.3% in FY2018.

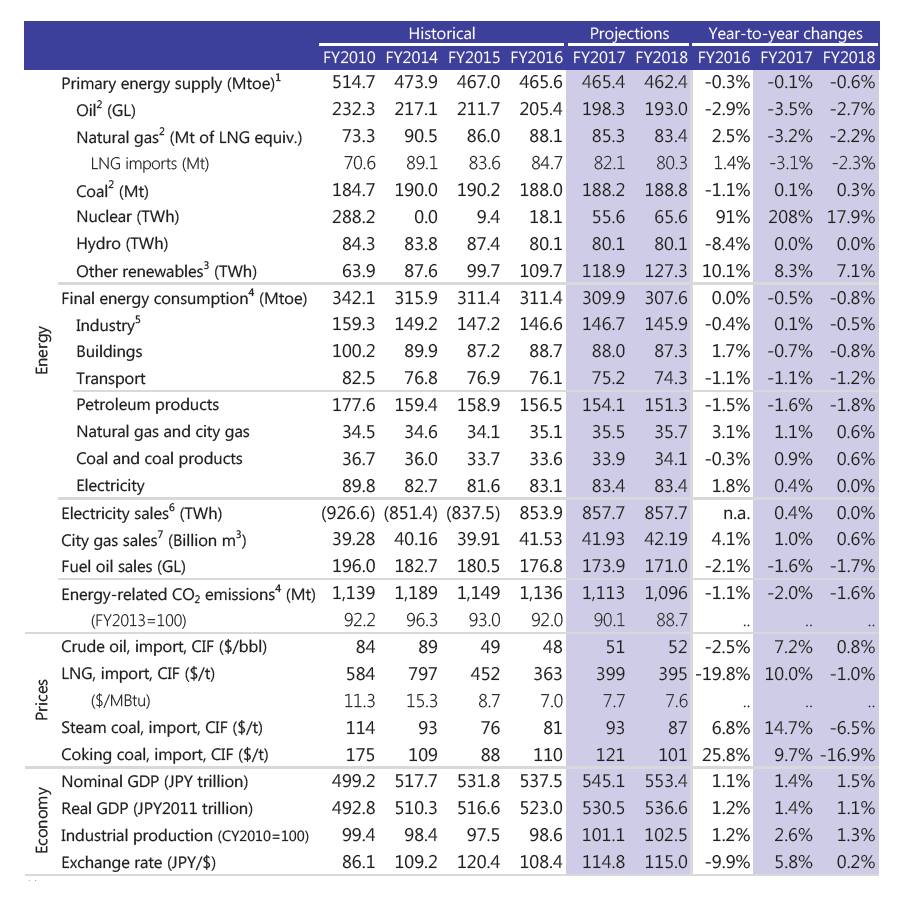

Executive summary of outlook through FY2018 [Reference Scenario]

Macro economy

The Japanese economy will grow at 1.4% in FY2017 because of favourable private consumption expenditure and strong exports supported by overseas economic growth. Despite a slowdown in exports in FY2018, the economy will continue to grow at 1.1% due to firm growth in domestic demand greatly influenced by Tokyo Olympic Games-related investment. Although growth keeps over 1% for four consecutive years through FY2018, it seems to be far from the Government’s target of a nominal GDP of JPY600 trillion.

Production activities

Since the exports of electric machinery grow alongside with the moderate restoration of overseas economy, the significant recovery of general and electric machinery production has a huge contributing factor to the overall production activities in FY2017. Also, the urban redevelopment and infrastructure construction for the Tokyo Olympics are among the contributing factors to the overall production activities. Production activities continue to enlarge in FY2018, although at a more moderate pace than the preceding year. Ethylene production declines as maintenance of plants increases relative to the previous year and as the competition for exports to China intensifies due to the operation of shale-derived ethylene plants in the United States.

Energy supply and demand

Although production and economic activities are growing, total primary energy supply in FY2017 declines slightly by 0.1% because of the continued advancement of energy efficiency. In FY2018, it decreases a little more (-0.6%) caused by more moderate production and economic growth than in the previous year. Oil dependence ratio falls to below 40% in FY2017, and the shift toward non-fossil fuels energy will continue to progress.

In FY2017, total final energy consumption in the industry sector increases slightly owing to expanded production activities (0.1%). The transport sector consumes less than in the previous year (-1.1%) due to an increase in the share of fuel-efficient cars. Consumption also decreases in the buildings sector (residential and commercial) mainly due to improvements in energy efficiency (-0.7%). Although overall production activities increase in FY2018, energy consumption in all sectors decreases. The industry sector’s consumption decreases by 0.5% from the previous year, due to a consumption drop in naphtha for the petrochemical industry. Consumption in the buildings and transport sectors declines due to further advancements of energy efficiency (buildings: -0.8%, transport: -1.1%).

Energy sales

In FY2017, electricity sales augment slightly (0.4%), because increased sales to industry (0.8%) for the expanded production activities surpass the decreased sales for lighting contract and low voltage due to the improvement of energy efficiency. In FY2018, the total electricity sales remain flat as the increase of electricity sales for industry (high and extra-high voltage) slows down (0.3%), in line with the production activities moderate growth, while low voltage sales decrease because of facilities’ efficiency improvement (-1.1%).

Total city gas sales reach a record high level in FY2017. They increase by 1.0%, led by growing sales to general industry (2.1%) that continuously seeks demand development activities. Sales for domestic use increase by 0.2% also because of the constant demand development. Sales for commercial and other uses drop by 0.4% because of the diffusion of more energy-efficient equipments. In FY2018, overall sales will reach the highest record for a third conservative year. Sales will rise moderately compared to the previous year (0.6%), led by increase sales for industrial use, while sales for domestic use will remain flat and those for commercial and other uses decline.

In FY2017, fuel oil sales decrease for the fifth consecutive year. The decrease of 1.6% in FY2017 is caused by a huge decline in the use of heavy fuel oil C for power generation (due to the return of nuclear power plants) and a decline in sales of kerosene and heavy fuel oil A, B and C because of fuel switching toward electricity and city gas. In FY2018, sales of all fuel oils will be lower by 1.7% than the previous year for the sixth consecutive year. Naphtha for the petrochemical industry turns to the decrease.

Renewable power generation

With regard to renewable power generation, a rapid increase in approved capacity under the FIT program seems suppressed by a fall in the electricity price for solar PV and the cancellation of previously approved capacities but non-operated. If the expired capacities were excluded from the approved 94.6 GW capacity at the end of February 2017, 66.9 GW would be operated. In this case, the cumulative amount of consumer burden for twenty years will reach JYP45 trillion (including capacities which were introduced before FIT and included in FIT later). This is equivalent to a rise in electricity price of JPY2,600/MWh – 11% for the residential and 16% for the industry sector.

CO2 emissions

Energy-related CO2 emissions, which reached a historical high in FY2013, will decrease for a fifth consecutive year through FY2018. Energy efficiency, the restart of nuclear power plants as well as an increase in renewable energy will lower the emission to 1,113 Mt-CO2 in FY2017 and 1,096 Mt-CO2 in FY2018 (9.9% and 11.3% less than in FY2013, respectively). FY2018 will be below 1,100 Mt-CO2 for the first time in 25 years, except for FY2009 just after the Lehman shock.

Table 1 | Summary of the Reference Scenario