RT A: IEEJ

| Organiser | The Institute of Energy Economics, Japan (IEEJ) |

| Date | 27 Oct 2016, 10:00 - 13:00 hrs |

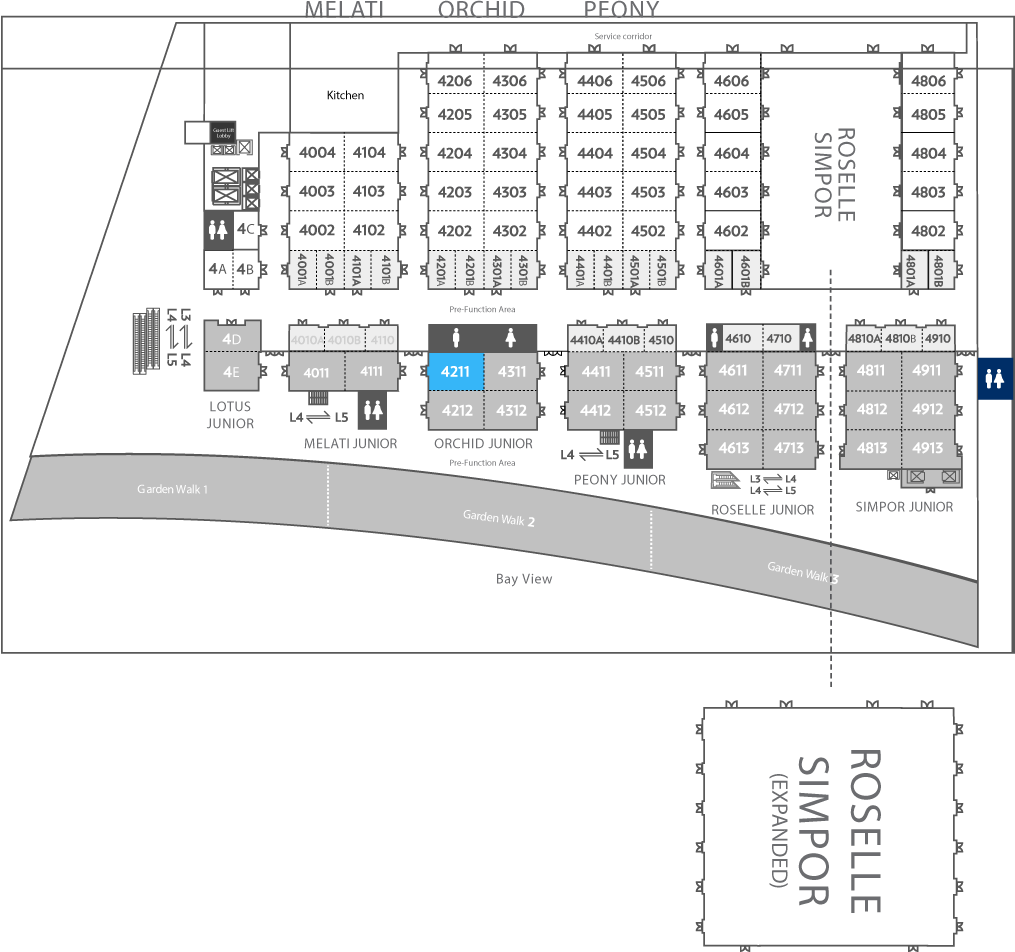

| Venue | Orchid 4211/12, Level 4, Sands Expo and Convention Centre, Marina Bay Sands Singapore |

Surplus supplies for both oil and gas have led to a decline in prices worldwide, especially given the US shale revolution. LNG spot prices in the Asian market have also dropped drastically to levels similar to those in Europe, while contract prices continue to be at a premium relative to the US and European markets.

In this regard, there have been discussions on changing the price mechanism for future long-term LNG contracts. Many are pushing for a shift from crude oil-linked pricing to market-based pricing. With lower energy prices and new LNG supplies expected to enter the market in the near-term, uncertainties remain for gas players. As such, the notion of creating an LNG hub in Asia and the formation of LNG portfolio management amongst buyers has become a source of debate within the industry.

This year’s IEEJ Roundtable at SIEW2016 will cover questions including:

- Will the current lower price situation induce demand for gas and expand Asian LNG market?

- How will LNG and natural gas compete with other sources in the energy mix?

- Will Japan achieve its “LNG Market Strategy” as announced in May 2016?

- Based on recent market developments, are there new price indices available to buyers for price index diversification? How can an alternative price index be developed for the Asian LNG market?

- What are the challenges ahead for LNG sellers and buyers? How can consumers and producers co-operate to increase LNG demand in Asia?

- What are the differences between EU and Asian LNG markets in terms of creating LNG hubs in the region? What are the prospects of creating an LNG hub in Asia?

Floor Plan

Related Slides

Outlook on Asian LNG: Market Dynamics and Pricing

Listen to SIEwCast

Episode 5: How FERC is reshaping the grid for the future