As the world accelerates towards a net zero future, securing the financing needed to build resilient, secure, and sustainable energy systems has become an urgent global priority. On 24 April 2025, over 100 industry leaders and energy experts convened at SIEWConnects@London, KPMG's London office, to advance this critical dialogue.

The event was part of the SIEWConnects series leading up to the Singapore International Energy Week (SIEW) 2025 in October. It underscored the collective effort required to transform ambitions into action under this year's theme, Envisioning Energy Tomorrow, Building Systems Today.

Financing the energy transition at scale

Mr Puah Kok Keong, Chief Executive, Energy Market Authority (EMA) of Singapore, opened the session by highlighting the significant investment needed to achieve net zero by 2050.

He noted that global energy demand rose by 2.2 percent in 2024, outpacing the decade-long average of 1.3 percent annually. This rising demand underscores the intensifying pressure on energy systems and the urgent need to accelerate financing for clean energy transitions.

The World Bank estimates that upwards of US$7 trillion annually will be required. Yet, current global investment levels stand at less than US$2 trillion—only about one-third of what is needed to achieve net zero by 2050.

Addressing this gap will require innovations across multiple fronts—from scaling renewable energy and deploying carbon capture, utilisation and storage (CCUS) solutions, to advancing hydrogen, next-generation nuclear technologies, and modernised energy grids. Equally critical is the establishment of bold and progressive policy frameworks to de-risk investments and accelerate deployment at scale.

"No single country or company can navigate the energy transition alone. Global collaboration, enabled by long-term policy certainty and bold innovation, will be crucial to unlocking the investments we need," noted Mr Puah. He also emphasised the importance of a long-term, macro view to foster policy certainty and unlock large-scale, confident financing decisions.

Singapore's multi-pronged strategy

Ms Liyana Gafoor, Principal Analyst, EMA, outlined Singapore's multi-pronged approach to advance the energy transition.

The approach focuses on diversifying natural gas sources to enhance energy resilience and support grid stability; maximising solar deployment supported by Energy Storage Systems to manage intermittency. The other two pillars comprise expanding regional power grid interconnectivity to access cleaner, cost-competitive energy sources; and investing in low carbon energy alternatives such as CCUS, hydrogen, geothermal energy, and advanced nuclear options.

Despite its limited natural resources, Singapore remains committed to net zero by 2050. Through a progressive carbon tax framework, investments in carbon capture and alternative fuels like ammonia bunkering, Singapore continues to demonstrate its commitment to energy transition. Singapore is also working towards greater regional energy connectivity through the ASEAN Power Grid initiative.

Ms Gafoor also shared that SIEW 2025 will be held in conjunction with Singapore's 60th year of independence. This milestone offers a timely platform to spotlight Singapore's long-term energy vision towards 2065.

Stability as the bedrock for investment

Mr Simon Thorne, Head of Global Carbon and Scenarios, S&P Global Commodity Insights, presented his assessment of the global energy transition in today's fractured world.

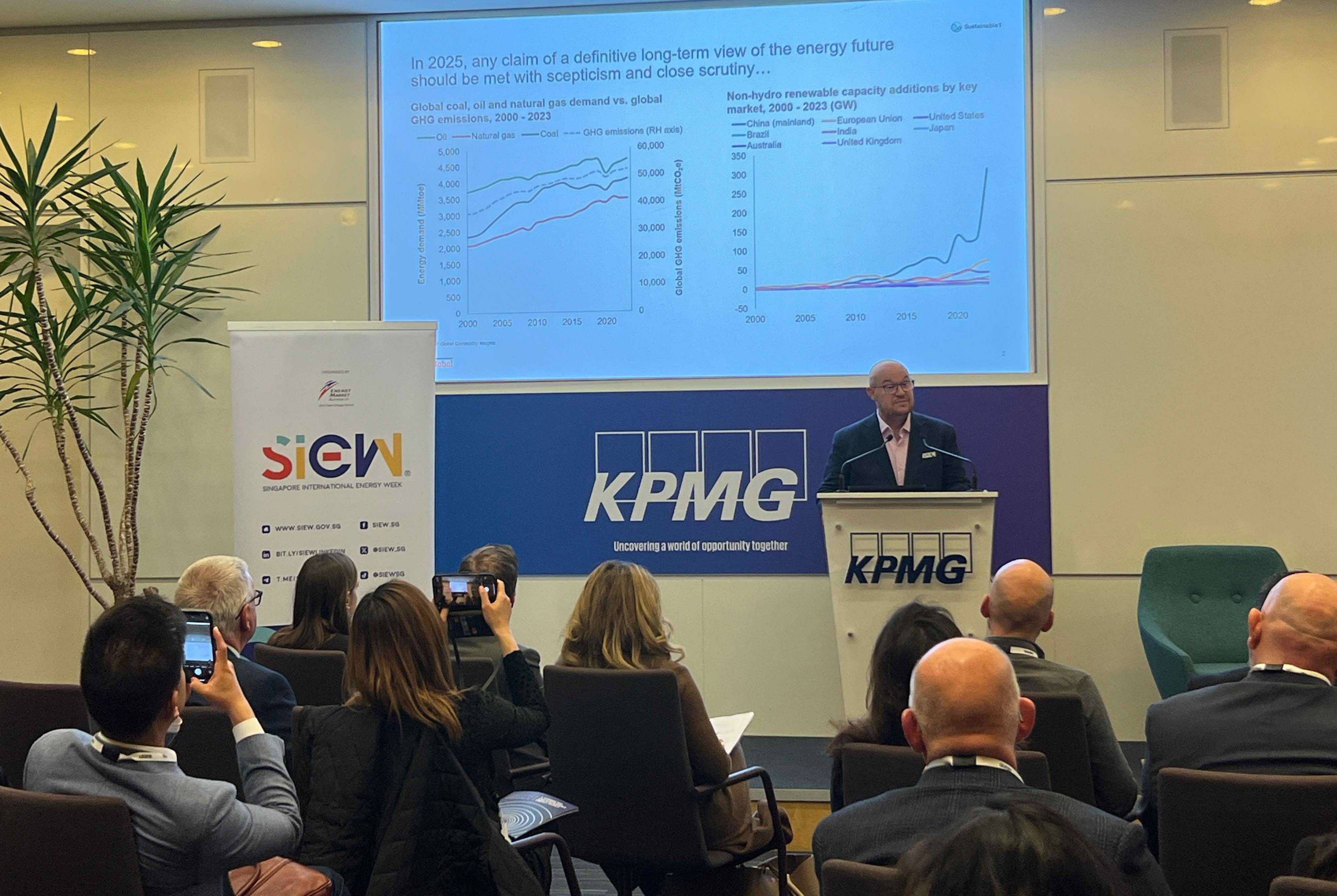

Drawing from S&P Global Commodity Insights' data, he showed that while renewable capacity additions have grown significantly, particularly in markets like China and the EU, global fossil fuel demand and greenhouse gas emissions have continued to rise. This demonstrates that the energy transition is more of an "energy addition" than a complete transformation.

He emphasised that through the 2020s, the energy transition will be defined by a struggle between policy and market forces. While over 90% of global emissions are now covered by net-zero pledges, these commitments vary significantly in their regulatory strength and implementation. Current projections suggest that no major economy is on track to meet its net-zero ambitions.

Mr Thorne outlined how the energy transition's success depends on three critical factors: the political landscape, the economic environment, and policy implementation. He stressed that in 2025, any claim of a definitive long-term view of the energy future should be met with careful scrutiny.

Mobilising capital to drive the energy transition

A dynamic panel discussion, moderated by Mr Adrian Scholtz, Global Head, Energy Deals, KPMG, explored practical strategies for financing the energy transition.

Mr Laughlan Waterston, Managing Director, Head of Energy Finance, EMEA, Global Structured Finance, SMBC, emphasised the key factors for successful importance of carbon capture and storage (CCS) deployment. These include stable regulatory frameworks, significant upfront government support, and strong industry sponsorship.

Ms Kelly Ripley, Head of Commercial CCS, Shell, echoed this view. She stressed the need for an integrated approach to de-risking. Ms Ripley also called for greater transparency and collaboration across the entire value chain, from service providers to emitters and governments.

Mr David Chui, Head of Structured & Project Finance, London Branch, OCBC, drew lessons from the early days of offshore wind development. He highlighted the role of pragmatic financial structures and government backing in scaling clean energy projects. These lessons, he noted, are now being applied to CCS.

Adding to the discussion, Mr Nomi Ahmad, Chief Executive Officer, Financial Services, GE Vernova, discussed the impact of the current hyper-inflationary environment on project bankability. He underscored the critical role of strong sponsor credibility and robust strong balance sheets in securing commercial viability.

Across the panel, a clear consensus emerged: stability, collaboration, and cross-border partnerships are essential to unlocking the large-scale capital flows needed to accelerate the energy transition.

Advancing collective action

As SIEWConnects@London concluded, it reinforced a fundamental truth: building the energy systems of tomorrow requires sustained collaboration, stability, and innovation. These pillars will continue to shape discussions as global energy leaders gather at SIEW 2025 in October.

SIEW 2025 takes place from 27 to 31 October at Marina Bay Sands, Singapore. Register your interest here.