The scale of the challenge is immense. To keep global warming below 1.5°C, the International Renewable Energy Agency (IRENA) revealed that the world will need US$2.2 trillion in annual investment in the power sector until 2050. Asia will drive a significant share of this transition.

On 22 August 2025, SIEWConnects@OCBC convened over 200 senior representatives from the industry and financial sectors to tackle a critical question. Their focus: how Asia can scale investment, strengthen cooperation, and deploy the technologies needed to power the region's clean energy transition.

As part of the global SIEWConnects series, the dialogue anchored the SIEW 2025 theme, 'Envisioning Energy Tomorrow, Building Systems Today'. Across the afternoon, one message came through clearly. How financing flows, how it is structured, and who it empowers will define Asia's energy future.

Asia's investment imperative

Opening the session, Mr Puah Kok Keong, Chief Executive, Energy Market Authority of Singapore (EMA), spoke about the scale and complexity of Asia's energy transition. He stressed that the region must mobilise significant capital to meet the region's growing energy demands while staying on track with its climate commitments.

He emphasised the importance of directing financing towards scalable solutions that can accelerate the energy transition. These include modernising power grids, integrating renewable energy and storage systems, and strengthening regional interconnectivity to support cross-border energy flows.

He also highlighted the importance of supportive policy frameworks and regulatory alignment to encourage greater private investment. He noted that collaboration between governments, financial institutions, and industry partners will be key to de-risking projects and attracting financing towards emerging markets.

Mr Puah further emphasised the need for a just and inclusive transition, recognising that Asia's diverse economies are at different stages of development. They will require tailored pathways to decarbonisation while safeguarding energy access and affordability, he added.

As part of SIEW's ongoing efforts to advance thought leadership, Mr Puah highlighted the launch of the SIEW Distinguished Speakers Series, which took place on 26 August. The inaugural session featured a dialogue with Ms Damilola Ogunbiyi, CEO and Special Representative of the Secretary-General for Sustainable Energy for All (SEforAll) and Co-Chair of UN-Energy. The series aims to foster energy leadership and sustain dialogue on the energy transition beyond the SIEW week in October.

Mr Puah closed his remarks by underscoring the importance of collaboration. He said: "No single actor can drive the energy transition alone. Governments, commercial and multilateral development banks, philanthropies and energy companies must align on our shared goals."

Singapore's highlights and SIEW 2025 announcements

SIEW's own perspective followed, with Mr Hayden Lee, Principal Analyst, External Relations Department, EMA, outlining highlights from the upcoming SIEW programme and Singapore's role in advancing sustainable energy finance.

He announced that the Singapore Energy Lecture will be delivered by Dr Tan See Leng, Minister for Manpower and Minister-in-charge of Energy and Science & Technology in the Ministry of Trade and Industry. Other featured speakers will include Malaysia's Deputy Prime Minister and Minister for Energy Transition and Water Transformation, YAB Dato’ Sri Haji Fadillah bin Haji Yusof. The programme will also welcome senior leaders from international organisations and industry CEOs.

Unlocking capital to accelerate the energy transition

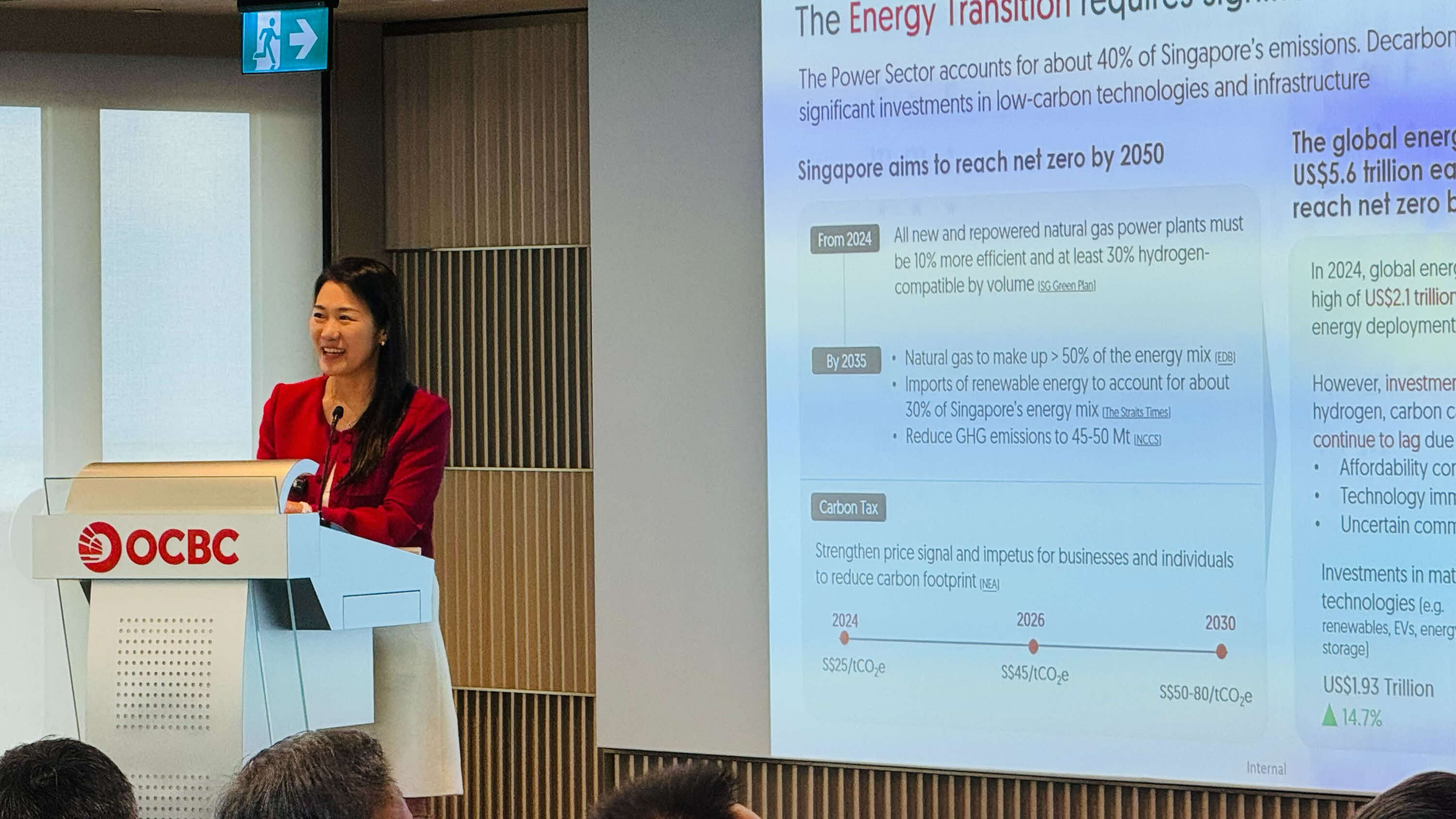

Ms Elaine Lam, Group Managing Director, Head of Global Corporate Banking, OCBC, spoke about the critical role of the financial sector in enabling Asia's energy transition. While global clean energy investments are on the rise, she noted that significant financing gaps remain — especially in Asia, where urgent action is needed to accelerate deployment.

Ms Lam stressed the need for new financing approaches and stronger collaboration between the public and private sectors to scale investment at speed and impact. She shared examples of OCBC's support for clean energy and infrastructure projects across Asia, including gas-fired power plants, rooftop solar, district cooling, desalination facilities and floating renewables.

OCBC has also partnered with export credit agencies to back projects in developing markets, especially those involving newer technologies and solutions. She added that the bank is actively involved in industry workgroups, including efforts to develop the Singapore-Asia Taxonomy and the world's first facility-level just transition guidelines for financing coal-to-renewable transitions. These frameworks, she explained, play an important role in guiding capital towards credible transition pathways.

Ms Lam concluded by emphasising that finance is a powerful enabler. But it must be paired with policy clarity, consistency, and collaboration to achieve a sustainable energy future.

Financing sustainable energy infrastructure

Following Ms Lam’s remarks, Ms Jeong Yoonmee, Head of the Sustainability Office, Global Wholesale Banking Division, OCBC, shared the bank's perspectives on transition finance. She also spoke about its role as a "connector of capital" supporting Asia's decarbonisation journey.

She stressed that the energy transition requires more than just capital. It also takes conviction and the courage to go beyond familiar approaches. She pointed out the bank's early decision to stop financing coal-fired plants and its adoption of international frameworks like the Poseidon Principles for shipping decarbonisation. These efforts, she said, reflect OCBC's ambitions to set new sustainability benchmarks.

Ms Jeong also highlighted the banks' role in financing both green and transitional solutions. She cited examples such as supporting the first carbon capture project in the UK, a sustainable aviation fuel system in the region, and a hydrogen-ready gas power plant. She added that OCBC has also joined the Green Fuels Board to accelerate innovation in cleaner fuels.

She further spoke about the bank's work in helping clients navigate evolving sustainability standards and developing credible transition frameworks amid differing views on decarbonisation pathways across markets. She shared that OCBC proactively leads industry working groups to shape best practices and guidelines for transition financing.

Scaling investment, balancing priorities

These themes carried into the panel discussion, where panellists explored how Asia can balance investment, innovation and collaboration to advance its clean energy transition. At the same time, the speakers acknowledged the trade-offs between ambition and pragmatism that shape the region's path forward. They highlighted that while opportunities are significant, scaling investment will require stronger bankability, clearer regulatory frameworks and deeper cross-border collaboration.

Moderator Sharad Somani, Partner & Head – Energy, Infrastructure and ESG, KPMG in Singapore, framed the discussion around the "5Ds" shaping Asia's transition. These comprise Decarbonisation, De-risking, Decentralisation, Diversification, and Digitalisation. .

The discussion then turned to balancing energy security with sustainability. Mr Alan Heng, Chief Executive Officer, Singapore GasCo, emphasised that while renewables are accelerating, natural gas remains vital for ensuring energy security and affordability. He added that Asia must balance net zero ambitions with the realities of economic growth, particularly in emerging markets.

Building on this, Mr Ivan Lim, Executive Director, OCBC, highlighted that energy policies must enable inclusive pathways that consider the needs of industries, businesses, and households while supporting workforce retraining. He added that financial institutions play an enabling role. They raise liquidity and manage risk, but depend on developers for technology choices and on governments and regulators for the frameworks that make projects viable.

From inclusivity, the discussion shifted to cross-border investment challenges. Ms Shen Chenhua, Fund Partner at I Squared Capital, noted that scaling cross-border energy investments will require predictable regulatory frameworks and clear market rules. She added that government-to-government engagement is essential to de-risk projects and attract private capital at scale.

The discussion then expanded to the role of collaboration and technology in accelerating Asia's clean energy transition. Mr Nitin Apte, Chief Executive Officer, Vena Group, called for stronger collaboration across the "3Cs": Collaboration, Clean energy, and Computing. He observed that Southeast Asia still has significant room to scale solar, wind, and storage solutions. He stressed that existing technologies can already be deployed today to meet rising energy demand. Mr Apte also pointed to the growing role of artificial intelligence (AI) and digitalisation in reshaping future energy needs.

The panel closed by emphasising that regional integration, including cross-border grids and aligned regulatory frameworks, will play an important role in scaling clean energy and supporting Asia's net zero ambitions.

Turning dialogue into deployment

The discussions at SIEWConnects@OCBC showed that the path forward will depend on mobilising capital, strengthening partnerships, and aligning policy with ambition. These priorities will drive deeper conversations at SIEW 2025 this October, as global energy leaders come together to envision energy tomorrow and shape the strategies needed to build the systems today.

SIEW 2025 takes place from 27 to 31 October at Marina Bay Sands, Singapore. Register now to enjoy early bird rates.