In 2009, the executive board of the clean development mechanism (CDM) shocked the carbon market by questioning whether Chinese wind projects satisfied the UN project-based mechanism's additionality [explanation here] requirements. CDM investors reeled as the safest CDM bet became the riskiest; the Chinese government publicly attacked the UN's oversight of carbon markets; and the board prepared itself for an unprecedented fight over how carbon offsets could be verified in the world's largest CDM market.

At the centre of the controversy was the concern that China's government might be manipulating power tariffs in order to guarantee additionality--whether or not a project would go ahead anyway without the CDM--and subsidise domestic renewable energy development with carbon finance. If it were, the credibility of the CDM in its largest market would be crippled. A solution to the controversy is, therefore, imperative--not just for future CDM investment in China--but for preserving the credibility of offsets as a global mitigation regime.

Yet, despite the best efforts of developers, designated operational entities (DOEs--UN-accredited companies that assist the project approval process) and the board to address this problem, a solution has so far remained elusive.

Mandates to compare power tariffs for new projects with the highest historical tariffs are not effective because both the Chinese wind industry and Chinese wind power pricing policy have changed since 2005. But, more importantly, the narrow focus on historical power tariffs risks missing the "forest for the trees" with regard to Chinese wind energy. The only way to solve the controversy and restore long-term stability to the market is to ask and answer the real question at the heart of the Chinese wind debacle: How can the CDM reliably separate the impact of domestic regulations and policies from that of international carbon finance. Some key research findings.

Our recent research at Stanford University addresses precisely this question, utilising an analysis of all Chinese wind projects registered through to 2009. Here, we present some key findings from that research. First, we demonstrate the structural dependency of internal rate of return (IRR)-based additionality in state-controlled power sectors on host country regulators. This dependency simultaneously gives host countries control of additionality outcomes, while preventing additionality verification by the UN, and is a major cause of the current problems.

Second, we argue that the available evidence does not suggest China is "gaming" the CDM. Finally, we argue that the CDM must upgrade the E+/E- policy--which guides decisions on registration of projects impacted by domestic policies--to deal with the reality of power markets where additionality is inherently impacted by domestic policy. However, this challenge presents a paradox for climate policy-makers that must be weighed carefully.

If China were manipulating power tariffs to game the CDM, it would be possible only because the current design of additionality gives it that power. The structural dependency of additionality on Chinese regulators can be clearly demonstrated. Additionality for Chinese wind is largely determined by IRR comparisons of CDM projects to baselines. Our analysis shows that the single largest factor determining a Chinese wind project's IRR is the power tariff. In fact, the data also shows that on average, an 11.35 percent increase in the power tariff will make Chinese wind farms non-additional.

The power tariff, in turn, is decided by China's National Development and Reform Commission (NDRC). Thus, the current additionality test makes the Chinese government the most important arbiter of additionality--whether it wants to be or not--because IRR-based additionality is, by design, a function of NDRC power pricing.

This would not be a problem if China had market-based power pricing that could be validated by CDM regulators. But China's power sector is not market-oriented. Unlike liberalised power markets, where prices are the result of bids and offers--subject to some regulatory constraints--China's power prices are either tightly controlled by state regulators or are distorted by the presence of large state-owned enterprises (SOEs). Wind is no exception. NDRC directly determines wind tariffs based on its own judgement of appropriate IRR. In fact, the official NDRC pricing policy of "cost + reasonable return (with consideration of available wind resources)", used until recently, explicitly indicates that the NDRC has determined the "reasonable return" through the tariff. But NDRC doesn't specify what the appropriate return is or how it is determined, which again is China's right, but a problem for CDM. In this context, it is nearly impossible to know whether China is taking advantage of the process or not. Put simply, IRR-based additionality tests are not well suited for China's state-controlled power pricing regime.

Further, where market-based pricing mechanisms have been tried, outcomes have been distorted by the presence of major SOEs not always motivated by market-based incentives. Investment and operations decisions in the power sector can be more sensitive to politics than profit, and politically-driven losses are subsidised by the state balance sheet.

A loss of 40 billion yuan

In 2008, China's "big five" generators alone lost 40 billion yuan (US$8.9 billion) because raw coal was worth more than tightly-capped power prices and generators were forced to run at a loss, which they wrote off as a "policy loss" that the government would make whole. Wind investment and pricing has been afflicted by a similar phenomenon. The national "concession system" for establishing wind power prices, which tried bidding by developers to establish tariffs five times from 2003–2009, certainly helped China move some projects closer to a market-based price discovery mechanism. But major SOEs were known to bid below market prices in order to win projects and meet central government renewable energy quotas.

Accordingly, observers have noted that the tariff outcomes of the concession system were artificially depressed and prices were low enough to discourage investment from private, non-SOE investors. These distorted concession prices heavily influenced the setting of current regional feed-in tariffs.

Any additionality test dependent on an IRR generated from Chinese power prices will, therefore, be inherently controversial and contestable. This problem is not limited to Chinese wind--it applies to almost all renewable energy projects in developing countries with state-controlled power sectors--and thus could damage the credibility of the CDM if not properly dealt with, at a crucial moment for international climate negotiations and deliberations in the US Senate.

Reform is necessary to use additionality metrics that are less dependent on domestic regulators. Possible reforms in the near term might contemplate using an enhanced barrier analysis, cooperating with NDRC to better understand domestic pricing policy, or using a more credible baseline. In the long term, carbon offset policy needs to be agnostic to market structure in developing country power sectors. The current thinking on sectoral approaches and the programme of activities offer a step in the right direction.

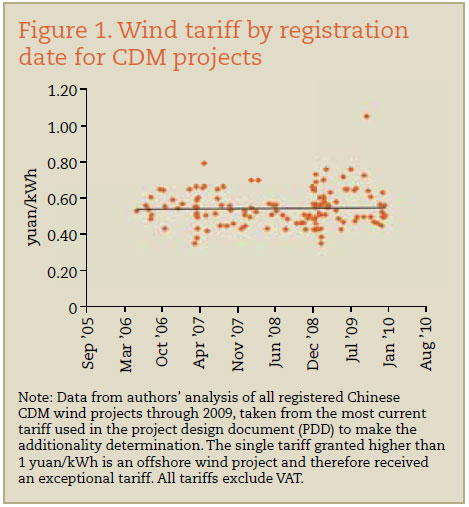

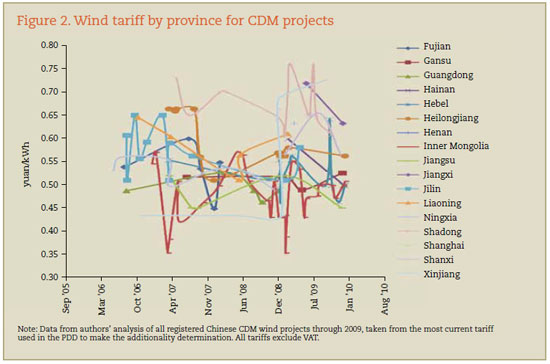

While the design of current additionality policy creates the opportunity for manipulation--without providing a way to prove it--the available evidence does not suggest that the Chinese government is gaming the CDM. Figures 1 and 2 show the trend in Chinese power tariffs granted to registered CDM wind projects since the inception of the CDM in China until November 2009. Though policies have changed, prices have not dramatically shifted lower. It should also be noted

that the Chinese feed-in tariff for wind is roughly 1.5 times higher than the average tariff for on-grid power; the average price granted to CDM wind projects was 0.5443 yuan/kWh (excluding value-added tax), and the average on-grid power price was 0.36034 yuan/kWh in 2008.

Thus, as the total wind capacity in China has risen, total subsidies paid by the Chinese government have rocketed to 2,379.94 million yuan in 2008, from 313.78 million yuan in 2005.

Even if reforms eliminated the dependency of additionality on domestic power pricing decisions, a difficult question remains. How should additionality account for the impact of broader changes in domestic policy over time. Rules needed for carbon market policy.

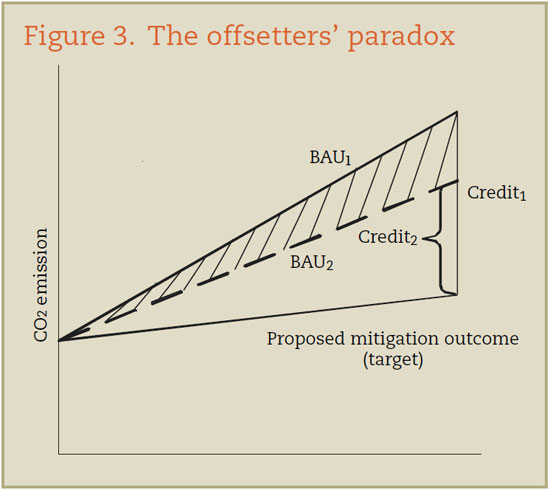

Carbon market policy must now craft rules for the entire CDM that segregate the impact of evolving domestic policy from the impact of carbon finance when judging additionality. Unfortunately, this challenge presents a paradox for policymakers.

On one hand, including domestic subsidies in the additionality calculation creates perverse incentives for the host country by making projects less eligible for CDM and, therefore, discouraging policies (E policies) that would jeopardise CDM revenues. On the other hand, ignoring these subsidies assures crediting for business-as-usual (BAU) projects, which reduces the integrity of global emissions caps.

This problem applies in nearly every situation where additionality is the central principle because additionality, by definition, compares a baseline of BAU with a lower emissions trajectory. Figure 3 shows that if credits are given for the difference between BAU1 and target trajectories, any domestic policy that lowers baseline emissions to create BAU2 reduces carbon payments, and, therefore, dis-incentivises domestic emission-reducing policies that would shift BAU1 to BAU2. Alternatively, if the offset mechanism attempts to solve the perverse incentive problem by crediting against BAU1 instead of BAU2 and ignores the domestic mitigation policy, then carbon offsets pay for what would have happened anyway (the shaded area). We call this tension of additionality the "offsetters" paradox'.

Post-CDM offset policy will need to confront this problem and decide how to strike a balance. This will become important as negotiators push for nationally appropriate mitigation actions in developing countries that give domestic policy a larger role in international climate policy.

Conclusion

As the CDM matures and approaches 2012--when the Kyoto protocol's first commitment period ends--the controversy over the additionality of Chinese wind offers key lessons for how the world can design, validate and implement carbon offsets. Short-term reforms can make project approval more credible and expeditious. Longer term, mechanisms that are agnostic to market structure and independent of domestic regulators offer a better chance of avoiding controversy and proving the viability of carbon markets as a sound mitigation regime. Finally, the design of any offset mechanism needs to confront the offsetters' paradox, because ignoring it will undermine the ability of the market to function.

The present analysis forces us to acknowledge additionality's dependence on domestic regulators in the near term and draw an uneasy line in the sand between creating perverse incentives and crediting for BAU in the longer term. Additionality and carbon offsets, more generally, are at best imperfect in the real world. Does that call into question the integrity of the global carbon cap.

Richard Morse and Gang He are Research Associates at the Program on Energy and Sustainable Development at Stanford University in the US. This article was first published in Trading Carbon Magazine in June 2010.

By : Richard Morse and Gang He