After an extended period of financial pain, most of China's power generators reported much-improved results in the first half of 2012. In a country where more than three-quarters of electricity is produced from coal-fired plants, the improved earnings in large part reflect the fact that power station coal prices fell steadily throughout the six-month period.

In the first half of 2012, domestic and imported coal prices fell as a result of the muted growth in electricity demand combined with high hydroelectric output, coal production and coal stocks. This has eased the pressure on thermal generators, who were already benefiting from increases in the second half of 2011 in the tariffs they receive for coal-fired power in much of the country.

From January to June 2012, China produced 1.95 billion metric tonnes (mt) of raw coal, an on-year increase of 7.7 percent. Most of the growth occurred in Shanxi, Shaanxi and Inner Mongolia, which produced 464, 214 and 517 million mt of raw coal, respectively.

The coal production increase easily outstripped the 2.5 percent on-year increase in fossil-fuelled electricity production. At the end of June, the price of Shanxi 5,500kcal premium coal at the key Qinhuangdao trading hub had fallen by 16 percent from the beginning of the year to yuan 670/mt (US$105.6/mt).

Shenhua Energy

Because it is an integrated coal and electricity producer, the first-half results of the China Shenhua Energy Company Ltd clearly show the shifting balance of power between Chinese coal and electricity producers.

After two years or so when generators were badly hit by a combination of spiralling thermal coal prices and fixed power sales tariffs, the first half of 2012 saw a general reversal of fortunes.

The Hong Kong-listed Shenhua Energy saw its profit from operations in the power segment increase by 22.2 percent in the first half of 2012 compared with the same period of 2011 to reach yuan 6.386 billion (US$1 billion). By contrast, its coal segment operating profit fell by 1.7 percent on-year to yuan 25.016 billion.

Shenhua Energy's revenues from power sales rose 23.6 percent on-year to yuan 36.027 billion in the first half of 2012. Coal sales revenues rose by 17.8 percent over the first half of 2011 to yuan 99.331 billion.

At a consolidated results level, the company saw its revenues for the first half of 2012 reach yuan 121.468 billion, an increase of 20.1 percent compared with the same period of 2011. Profit attributable to shareholders totalled yuan 26.741 billion, an increase of 17.2 percent on-year.

Shenhua Energy saw its power output in the first half of 2012 reach 95.66TWh, an on-year increase of 15.3 percent. At the end of the period the installed capacity controlled by the company reached 39,911 megawatts, up 3.9 percent from the beginning of the year and including 91 coal-fired generators.

Shenhua Energy said that "efforts were made to give full play to the synergy effect generated from the internal coal and power segments with an aim to expand market share". In the first half of 2012, the company's power plants used 46.0 million mt of coal, of which 39.3 million mt was purchased from Shenhua's coal segment.

The average power sales tariff of the company's coal-fired plants was yuan 363/MWh during the first half of 2012, an increase of yuan 17/MWh compared with the same period of 2011. Meanwhile, the unit cost of its power output rose by 8.1 percent on-year to yuan 293.7/MWh.

The average utilisation of its coal-fired generators at 2,603 hours was 114 hours above the average for Chinese coal-fired plants, Shenhua Energy said. Meanwhile, coal consumption was 322g per kWh.

Shenhua Energy has acquired many of its generating assets from its parent, the state-owned Shenhua Group. In the first half of 2012, this included a 50 percent equity interest in the Guohua Taicang Power Co, Ltd, while the company separately acquired a 51 percent interest in the Sichuan Bashu Power Development Company Ltd from the Sichuan Provincial Investment Group Company Ltd for yuan 1.651 billion in cash, securing control of a further 1,260MW of coal-fired plant.

Shenhua Energy said that at 30 June 2012, its market capitalisation was US$70.46 billion. This meant that it ranked first among listed coal companies worldwide and fourth among listed integrated mining companies worldwide, the company said.

CPID

While Shenhua Energy owns a small amount of hydroelectric plant and is developing some gas-fired capacity, it is primarily a coal-fired generator. In this respect it differs from some other generators such as the Hong Kong-listed China Power International Development Ltd ( CPID ), which reported revenues of about yuan 9.101 billion (US$1.43 billion) in the first half of 2012, an increase of 11.22 percent compared with the same period of 2011. It also reported a marked jump in profit attributable to shareholders of yuan 547.8 million, up 33.12 percent on-year.

Part of the profit increase compared with the first half of 2011 came from better financial performance by CPID's coal-fired plants. But the company's hydroelectric plants still produced a larger share of its net profit.

At 30 June, CPID's 11,831MW of equity capacity included 8,917MW of coal-fired plant and 2,914MW of hydropower capacity. In the first half of 2012, the net profit contributed by its hydropower plants was yuan 429.03 million, while the net profit of its coal-fired plants was yuan 351.34 million.

The company's power generation rose by 4.24 percent to 27.014TWh. Coal-fired and hydro output reached 21.013TWh and just over 6TWh, respectively.

CPID said the output of its hydropower generators had risen significantly as a result of improved rainfall and dam water levels in the first half of 2012. The average utilisation of its hydropower plants rose 273 hours from the first half of 2011 to 1,715 hours in the same six months of 2012.

By contrast, the average utilisation hours of its coal-fired plants fell 280 hours on-year to 2,679 hours. But its overall electricity sales volume from coal increased as several new coal-fired units entered operation after June 2011 and contributed to production in the first half of 2012.

CPID noted that its on-year profit for the six months had jumped by a third in part because the average on-grid tariff for its coal-fired power production had increased by yuan 34.08/MWh after the first half of 2011 to reach yuan 376.35/MWh in the first half of 2012. This increase more than offset a decrease of yuan 9.15/ MWh in the average on-grid tariff of its hydropower plants to yuan 276.82/MWh.

Operating costs increased 7.7 percent on-year to yuan 7.463 billion, mainly due to increased fuel costs and depreciation. Fuel costs of yuan 5.231 billion increased 5.88 percent on-year.

Although CPID noted that the spot price of coal had fallen in the first half of 2012, it said that its average unit fuel costs were 3.76 percent higher on-year at yuan 265.81/MWh for the six-month period. The company said the increase was due to the fact that 75 percent of CPID's coal requirements are supplied under contract, whose unit cost had risen by an average of 5 percent on-year in the first half of 2012.

At 3.76 percent, the coal price increase was modest by recent standards. It was more than offset by the tariff increase as well as by moves to further reduce the amount of coal used to generate each unit of electricity--down 2.40g/kWh at 317.07g/kWh--and the replacement of small, less efficient generating units with large-scale sets.

Looking forward, CPID said it is "actively seeking development opportunities for both coal-fired power and hydropower projects". It noted that the total capacity at the preliminary stage of development--including plants where national government approvals have been applied for--is more than 7,400MW, of which coal-fired capacity amounts to 7,200MW.

The coal-fired projects include two 1,000MW units at Pingwei-3, two 1,000MW units at Shanxi Shentou, two 600MW units at Guizhou Pu'an and two 1,000MW units at Changshu. "In addition, the group will continue to further expand coal-fired projects in developed areas such as the coastal areas of Guangdong province," CPID said.

The remaining 200MW of capacity at a preliminary stage of development and acquisition comprises small and medium-sized hydropower projects in the southwest of the country, the company said.

Datang Power

Meanwhile, the Datang International Power Generation Co, Ltd, China's second-largest listed generator, has posted a 23.87 percent on-year increase in net profit attributable to shareholders at yuan 1.154 billion, and a 10.67 percent increase in revenues at yuan 36.877 billion for the first half of 2012. While the company has diversified in recent years into large-scale coal, chemical and synthetic gas production projects, all these facilities are either still under construction or at an early stage of production, and power generation still accounted for more than 90 percent of the company's revenues during the six-month period.

Datang Power generated 97.6TWh in the six-month period, up only 1.5 percent on-year even though its hydroelectric output increased by 25.74 percent . The revenue contribution from increased generation was thus only Yuan 477 million, whereas the company said that the 6.59 percent on-year increase in its average power sales tariff resulted in a revenue increase of yuan 2.026 billion.

The company controlled 38,865MW of capacity at the end of June 2012, of which 84.2 percent was coal plant, 12.4 percent hydropower plant and 3.3 percent comprised wind turbines.

During the period three projects were approved by the state, including a 1,380MW gas-fired project at Gaojing in Beijing, a 125MW hydro project in Chongqing and a 48MW wind project in Liaoning province. The company said this mix of projects was in line with its strategy of "optimising its coal-fired power; aggressively expanding its hydropower; continuously developing wind power; strategically developing nuclear power; appropriately developing solar power".

Gas is also key to its expansion plans, with two Datang Power projects advancing in early September. These included the Gaojing project, with the US-based equipment manufacturer GE saying that it will supply three 9FB gas turbines for the 1,380MW combined-cycle cogeneration project. GE said that use of the turbines in the plant, which is already under construction, will mark the debut of the technology in China.

GE said that, in addition to the turbines, it will supply equipment and services to its business partner and licensing associate, the Harbin Electric Corporation, which is building the plant for Datang. It added that "when combined with Harbin's district heating solution for winter operation, at greater than 59 percent at ISO conditions, it is expected to be one of the most fuel-efficient Chinese power plants to date".

GE said that it expects to ship the equipment starting in October 2012. The plant is scheduled to begin the first stage of commercial operation in October 2013.

The Gaojing equipment award came at the same time as GE was awarded the contract to supply five Frame 6FA gas turbine-generators for three cogeneration plants in Zhejiang province. GE said that it will supply two of the 115MW gas turbine-generator sets to Harbin Electric, which is the main equipment contractor for a combined-cycle plant in Jiangshan county owned by Datang Power.

GE will supply two of the other units to Quzhou Puxing, a subsidiary of Wanxiang Group, which will supply power for the Quzhou Kecheng economic development zone. The final gas turbine-generator will be supplied to a 115MW open-cycle plant near Huzhou city owned by Amber Energy Co Ltd.

The Zhejiang plants are all due to enter commercial operation in December 2012. Natural gas from the second west-east pipeline will be the primary fuel for each plant.

Huadian fortunes

China's third-largest listed generator, the Huadian Power International Corporation Ltd, saw its profit rise by 169 percent in the first half of 2012, but from a very low base to only yuan 284 million. Turnover increased by 11.52 percent on-year to yuan 29.437 billion, as power generation rose by 6.28 percent to 78.35TWh.

Huadian Power saw its operating expenses rise by a modest yuan 1.372 billion against the increase in turnover of yuan 3.04 billion between the first-half periods of 2011 and 2012. However, the company's earnings performance was reined back in part because of a yuan 912 million rise in finance costs between the two periods as a result of its aggressive investment programme, which is intended to diversify its activities away from coal-fired plants in Shandong province.

The 38 operational power plants controlled by Huadian Power at June 2012 had 30,530MW of capacity, of which the group directly owned 26,488.28MW. Almost 2,600MW of the controlled plant comprised hydro, wind, solar and biomass-fired units, while the rest was coal, but the 645MW of total capacity added in the first half of 2012 included 460MW of hydro and 185MW of wind turbine capacity.

Huadian Power also controls or has invested in 16 coal mining enterprises with coal reserves of about 2.1 billion metric tonnes. The mines have 12.89 million mt/year of projected average production capacity.

Huadian Power is an indirect subsidiary of the China Huadian Corp, one of the five state-owned power generation groups carved out of the State Power Corp in 2002. China Huadian also controls the Huadian Fuxin Energy Corp Ltd, which held its initial public offering in Hong Kong in 2012.

Huadian Fuxin was traditionally involved in the development and operation of hydroelectric and coal-fired plants in Fujian province, and is also involved in wind and other clean energy projects throughout China.

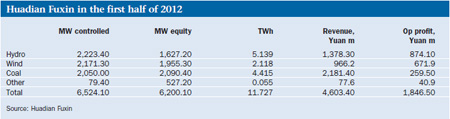

At the end of June 2012, Huadian Fuxin controlled 6,524.1MW of operational capacity including 2,223.4MW of hydro, 2,171.3MW of wind, 2,050MW of coal and 79.4MW of other capacity.

Huadian Fuxin's more diverse portfolio meant that although its revenue for the first half of 2012 was much lower than that of Huadian Power, at about yuan 4.63 billion, its net earnings were significantly higher at yuan 786 million, up 168.1 percent from the first half of 2011. The company's generation totalled 11.73TWh, an increase of 48.5 percent over the same period of 2011, and with hydroelectric output up 74.1 percent at 5.14TWh, coal-fired production 38.9 percent higher at 4.42TWh, and wind output up 45.6 percent at 2.12TWh.

Huadian Fuxin's average on-grid tariff of yuan 320.9/MWh at June 2012 for its hydropower plants was up 7.9 percent on-year, with four projects securing approval for a yuan 40/MWh increase in tariffs in December 2011, and 29 projects getting approval for increased tariffs in March 2012. Meanwhile, the average tariff for its wind plants was yuan 563.8/MWh, an increase of yuan 1.7/MWh on-year, while the average on-grid tariff for its coal-fired plants of yuan 450.1/MWh was up 5.6 percent on-year.

In an indication of the current profitability of hydropower plants, Huadian Fuxin noted that its hydroelectric plants accounted for yuan 1.378 billion of its revenues in the first half of 2012, but yuan 874.1 million of its operating profit. By contrast, its coal-fired plants produced yuan 2.181 billion of its revenues, but only yuan 259.5 million of the operating profits.

Wind farms were even more lucrative for Huadian Fuxin. They generated yuan 966.2 million of revenues against yuan 671.9 million of its operating profits.

Many of Huadian Fuxin's identified future power generation projects involve wind farms. Its pipeline of wind projects includes 41,323MW of overall capacity, with advanced and medium-term wind projects amounting to 523.5MW and 2,820.5MW, respectively.

However, Huadian Fuxin has also said that leveraging the experience it obtained from developing the Guangzhou University Town project, it had secured a substantial pipeline of projects in the distributed energy area. Three such projects were approved in the first half of 2012 with 143.2MW of capacity.

The company has 258MW of distributed energy projects under construction, while its pipeline of advanced, intermediate and preliminary projects totals 487.2MW, 1,522MW and 5,499MW, respectively.

Huadian Fuxin noted that its distributed energy projects are generally fuelled by natural gas. The company also holds 39 percent equity interests in four 1,000MW constructing nuclear reactors. One unit is expected to commence operation each year from 2013 to 2016.

In June 2012, Huadian Fuxin also had 79.4MW of installed solar capacity as well as of 550MW of solar projects in the pipeline. And two biomass-fired projects with 25.3MW of capacity were under construction fors cheduled operation in the second half of 2012.

Longyuan Power

Wind farms also proved lucrative for the China Longyuan Power Group Corp Ltd, a Hong Kong-listed subsidiary of the state-owned Guodian Group and one of the country's first and largest renewable energy-based generators. Longyuan Power saw yuan 2.797 billion of its yuan 3.321 billion of operating profits in the first half of 2012 come from the wind farms that accounted for only yuan 3.891 billion of its near yuan 8.260 billion of total revenues.

On the cost side, the wind farm segment also accounted for the great majority of its depreciation and amortisation costs--yuan 1.496 billion out of yuan 1.802 billion--and interest expenses, which accounted for yuan 1.030 billion out of the yuan 1.214 billion of total expenses.

The company's 8,944MW of wind farm capacity produced 8.43TWh of its 14.33TWh of first-half output, up 19.3 percent on-year, whereas the output of its 1,875MW of coal-fired generators fell 3.8 percent on-year to 5.62TWh.

Longyuan Power also owned 240MW of biomass-fuelled and solar plant at June 2012, when its total capacity was 11,109MW. The wind farm portfolio included 131MW of operational offshore wind farms.

While a longstanding developer of wind farms, Longyuan Power said that the sector had not been without problems in the first half of 2012, with lower than average wind speeds being compounded by longstanding problems related to the grid connection and dispatch of wind farms. The company said that it had thus "contracted the scale of wind power construction in regions subject to severe grid curtailment [and] tilted the focus towards the projects in central, eastern and inland regions valuable for development".

Longyuan Power also noted that it had "endeavoured to boost the quality of feasibility studies on projects by implementing more stringent internal standards on project approval, so as to truly reflect and strictly control investment risks". The company added that it had a wind power project development pipeline of 63,850MW as at June 2012.

Overall, Longyuan Power posted an 8.3 percent on-year increase in revenues in the first half of 2012. Net profit attributable to shareholders was up 3.6 percent on-year at yuan 1.46 billion.

Conclusions

Longyuan Power observed at one point in the discussion of its results that the first half of 2012 had seen "bewildering and challenging economic conditions at home and abroad", a position that all Chinese generators would heartily endorse.

Coal prices fell during the period, but so did the share of coal-fired generation in a market characterised by muted growth in demand; wind output faced even more constraints for many producers as a result not of slow demand growth but lower wind speeds overall and persistent grid connection and dispatch problems; hydroelectric output was buoyant but remained predominantly weather-related and--as for all forms of Chinese power generation--faces highly-localised conditions at regional and provincial level.

Company revenue results in terms of on-year growth were also and unsurprisingly often dependent on past expenditure levels, with implications for future debt levels, while profit growth more often than not reflected the company's base position in the first half of 2011.Picking winners and losers in the Chinese generator market thus remains very much a lottery.

Longer term, though, the fortunes of companies operating in the Chinese generation market will remain unpredictable until the long-promised liberalisation of the wholesale power business eventuates, and on-grid tariffs are set by the market rather than regulators. With power sales tariffs currently adjusted retrospectively and with primary regard to macroeconomic considerations, the most successful companies are currently still those better able read the political runes rather than market forces.

This article was published in the September issue of Platts Energy Economist. Platts recently organised the 2012 Platts Top 250 Asia Awards Dinner at SIEW 2012.

By: Platts Energy Economist