Photo Credit: iStockphoto.com

Superlatives are often used to describe the Chinese power sector, but its growth over the last two decades has been unprecedented in its own right, as well as in the context of other industrialised nations. Power output doubled between 1990 and 2000. The next doubling occurred between 2005 and 2006, and the third is likely to have occurred this year. What's more, China has entered into this parabolic phase of growth far earlier in its development cycle than comparable countries.

Per-capita power consumption of approximately 800kWh per year marks the boundary of an economy heading into a rapid industrialisation phase. China made this transition at the turn of the century, Japan and Germany in the 1950s, and the United States during the late 1930s-early 1940s. Yet China's GDP per person in 2000 was approximately US$1,000, far lower than levels recorded in the other countries as power consumption began to rapidly increase. China appears to be industrialising 40 years ahead of the template established by other--now developed--countries.

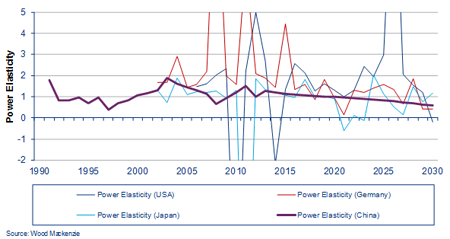

While timing of this growth in power demand is far in advance of other countries, its shape mirrors their histories quite well. Japan is a particularly suitable analogue for the ratio of power demand to GDP growth, known as "power elasticity". During the 1960s, Japan's power elasticity averaged 1.2, meaning the rate of power demand growth was slightly in excess of that of GDP growth. During China's comparable decade, the 2000s, power elasticity averaged 1.25. By 2020 we expect China's power elasticity to drop permanently below 1, and will reach approximately 0.6 by 2030. In other words, power demand will be growing at roughly half the rate of GDP by this time. During this phase of development, Japan's power elasticity averaged 0.7. Therefore, as well as beginning its industrialisation phase earlier in the development cycle, China is also expected to accelerate the transition to more efficient use of electricity (in GDP terms) than other industrialised countries.

China power elasticity 1990–2030 vs other countries (rebased to same stage of development)

Meanwhile, we retain a robust outlook for Chinese GDP growth over the next two decades--annual rates will average 7.2 percent between 2012 and 2030, over which time the economy will approximately triple in size. This means, despite the substantial decline in China's power elasticity over the 2010s and 2020s, total power demand is also set for precipitous growth. The fourth doubling of demand will occur in the early 2020s, the fifth likely in the early 2030s. By 2030, China's power demand will have tripled, relative to 2012. The capacity additions needed to satisfy this demand will make China the world's largest power market, by a significant margin.

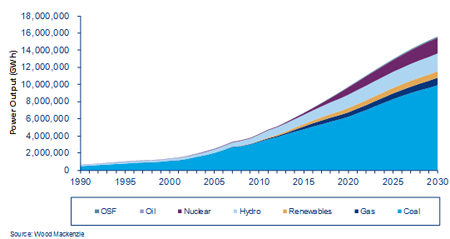

Today, China's power market is dominated by coal. Installed capacity of over 800 GW generates 76 percent of total power output. Hydro is the next largest source of electricity; capacity is approximately 230GW and output is 17 percent of the total. Other forms of generation have seen rapid growth in recent years but still account for only a minority share of power supply. Nuclear power has grown to 10GW in 10 years, while the rise of renewables has been even more dramatic: Over 50GW now installed, from negligible amounts during the mid-2000s. Yet combined, the two account for less than 4 percent of total output. Gas is even more insignificant, representing less than 2.5 percent of power supply.

By 2030, the power supply mix will see fundamental structural changes. Nevertheless, coal will continue to underpin China's power output. Approximately 64 percent of China's electricity needs will be generated by 1.7 TW of coal-fired capacity. Hydro will remain the second-largest source of electricity, but nuclear will be almost at parity. By 2030, China's nuclear fleet could be as large as 230GW, approaching double the United States (expected at 113GW in the same year). The rate and scale of capacity build needed to attain this target will mean China is the focus of global nuclear new-build over the next 20 years.

China power output by fuel, 1990–2030

Given the intermittency of renewable generation, this form of supply will only contribute 5 percent of China's power needs in 2030. However, even this level of output will require the construction of 300GW of wind, and over 120GW of solar capacity. Natural gas will also see significant growth, to over 200 GW of installed capacity, but the sheer scale of China's total power demand means gas-fired output will represent only 6 percent of the total.

If GDP growth rates averaging 7.2 percent are to be achieved, guaranteeing sufficient power supplies will be paramount. All forms of generation should see tremendous growth. China's development over the last two decades has been dramatic, but the stage is set for the next phase, one that will unequivocally put China at the heart of the world's energy markets.

Paul McConnell is an Energy Markets Senior Analyst from Wood Mackenzie. Wood Mackenzie took part in the recent Singapore International Energy Week (SIEW) 2012.

By :Paul McConnell, Wood Mackenzie