On October 27, 2022, private and public sector representatives from the United States shared their experiences on how the U.S. has become a global leader in battery energy storage system (BESS) deployment alongside leaders from several Asian countries which are at the outset of their journeys to bring more energy storage into their systems.

The Thinktank Roundtable panel, co-hosted by the U.S. Department of State’s Bureau of Energy Resources (ENR) and the Energy Market Authority (EMA) of Singapore with the U.S. Department of Energy (DOE), featured U.S. government and industry perspectives on U.S. deployment and procurement experiences with BESS. The discussion includes policy and regulatory frameworks, remuneration approaches, technology trends, use cases and applications, and technical and commercial benefits. Experts shared BESS implementation case studies in the U.S., highlighting how BESS dispatched reliable and stable energy during extreme weather events or periods of high energy demand. By providing operational and planning insights in specific markets and states across the U.S., speakers highlighted how storage can benefit the Asian region and how countries can facilitate its growth in their power markets depending on its characteristics.

Speakers focused on lessons learned from these U.S. use cases and discussed leading practices that East Asia Summit (EAS) members can consider to minimise the barriers to implementation and maximise the benefits of BESS. Officials from EAS member countries, including Singapore, Malaysia, and Thailand, discussed national efforts to promote BESS and regional perspectives, focusing on their countries’ initiatives to procure, install, and operate BESS.

The Roundtable included the following speakers, shown in order of appearance:

- Garrett Barnicoat, Indo-Pacific Team Lead, Bureau of Energy Resources (ENR), U.S. Department of State, Roundtable Emcee;

- Jonathan Goh, Director, External Relations Department, EMA;

- Elizabeth Urbanas, Deputy Assistant Secretary for Asia and the Americas, U.S. Department of Energy;

- Celeste Marshall, Desk Officer for Southeast Asia, Office of Asian Affairs, U.S. Department of Energy;

- Adrian Rouse, Technical Team Lead, Deloitte, on behalf of the U.S. Department of State, ENR, Power Sector Program;

- Achal Sondhi, Vice President of Growth, APAC, Fluence;

- Shiv Aggarwal, Commercial Leader APAC Region, General Electric (GE) Renewable Energy;

- JD Brannock, Director of Storage Development, Leeward Renewable Energy, LLC;

- Ir. Ts. Abdul Razib bin Dawood, Chief Executive Officer, Energy Commission, Malaysia;

- Dr Narin Phoawanich, Assistant Governor, Fuel Management, Electricity Generating Authority of Thailand;

- Chris Davy, Director for the Middle East and Asia, Bureau of Energy Resources, U.S. Department of State, moderator; and

- John Garvey, Legal and Regulatory Specialist, Deloitte, on behalf of U.S. Department of State, ENR, Power Sector Program.

Throughout the Roundtable, public sector, and private sector speakers from both the U.S. and Asia emphasised the importance of creating appropriate market rules and regulations and directly engaging in a collaborative dialogue to understand how to develop the market. Technological innovation is driving down BESS costs and regulatory changes are opening market opportunities to generate revenue. Deploying a new technology at this scale takes foresight, active engagement with the industry, and the ability to test out different approaches. A key takeaway was that the public sector and private sector must engage with each other to scale BESS and achieve their renewable energy goals. We introduce each speaker’s main talking points and summarise their presentations below:

Figure 1: Garret Barnicoat, Indo-Pacific Team Lead for ENR

Garrett Barnicoat, Indo-Pacific Team Lead, ENR, U.S. Department of State welcomed the audience and cited the importance of the opportunity for the U.S. to be a part of the SIEW. He introduced the overarching theme of the Roundtable: scaling BESS, which is critical to storing and releasing clean energy during times of intermittency or grid congestion and will help governments and utilities achieve their renewable energy goals. The public and private sectors need to work together to scale BESS solutions.

Figure 2: Jonathan Goh, Director, External Relations Department, EMA

Jonathan Goh, Director, External Relations Department, EMA, reiterated the importance of deploying BESS as an enabler to the clean energy transition in Southeast Asia. BESS can reduce the cost of capital-intensive transmission or distribution upgrades and provide important services to support grid stability and resilience. Mr Goh noted that Singapore had recently deployed its first BESS, a 2 MW/2 MWh project at Pasir Panjang Terminal, and had also recently launched an Expression of Interest for a developer to build, own, and operate 200 MW/200 MWh of BESS in Singapore.

Figure 3: Elizabeth Urbanas, Deputy Assistant Secretary for Asia and the Americas, DOE

Elizabeth Urbanas, Deputy Assistant Secretary for Asia and the Americas, DOE, discussed how policy changes and public sector funding are driving the growth of renewable energy deployment in the U.S.. Recently, the U.S. passed historic legislation including the Bipartisan Infrastructure Law, the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act. These pieces of legislation will provide significant funding to incentivise BESS deployment and capitalise on the DOE’s strength in research into renewable energy technologies through its laboratories and science-based offices. Innovation in BESS technology remains the most critical component of cost reduction. Countries around the world, including those in Southeast Asia, will benefit from the U.S. innovation in more effective and cost-efficient BESS systems.

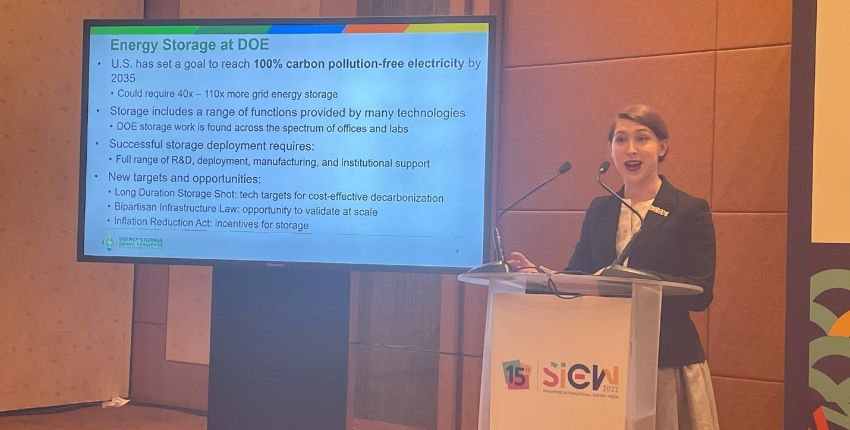

Figure 4: Celeste Marshall, Desk Officer for Southeast Asia, Office of Asian Affairs, DOE

Celeste Marshall, Desk Officer for Southeast Asia, Office of Asian Affairs, U.S. DOE, presented an overview of energy storage technologies in the U.S.. Ms Marshall discussed the different types of short-, medium-, and long-term duration energy storage technologies, noting that the U.S. is witnessing a higher demand for long-term storage technologies. Lowering energy storage system costs is a key step in increasing the volume of long-term storage projects, which may enable consumers to access more renewable energy and reduce electricity costs. Ms Marshall concluded by highlighting four long-duration energy storage demonstration programs. She noted that the DOE invested $355 million into demonstration projects and pilot grants to lower the barriers to storage deployment. The DOE also invested $150 million into demonstrating innovative early-stage long duration technologies and a joint resilience programme with the Department of Defense.

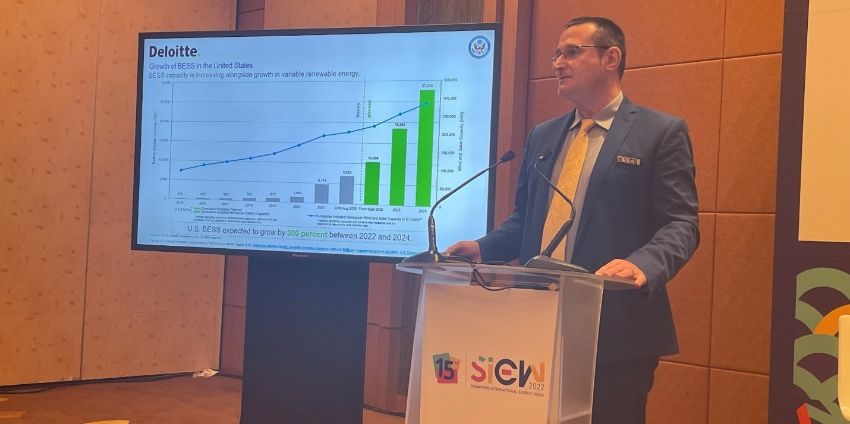

Figure 5: Adrian Rouse, Technical Team Lead for Deloitte

Adrian Rouse, Technical Team Lead for Deloitte, presented an overview of BESS market trends, regulatory drivers, and procurement methods in the U.S.. Installed BESS capacity has grown from 275 MW in 2015 to 6,853 MW in August 2022. BESS is expected to grow another 300 percent between 2022 and 2024, to a total installed capacity of 27,805 MW.[1] As the amount of variable renewable energy (VRE) grows in the U.S., operators will need to consider the amount of storage they need to maintain a reliable grid. Grids require a higher deployment ratio of BESS to renewable energy as VRE deployment increases to help balance the system. For example, the U.S. state of California may require 0.6 MW of storage for every MW of VRE, whereas New York may need 0.5 MW of storage for every MW of VRE to stabilise the grid and reduce curtailment. Policy changes, such as Federal Energy Regulatory Commission (FERC) Order 841 from 2018 and FERC Order 2222 from 2020, have been significant enablers of BESS growth in the U.S. markets. FERC Order 841 removed barriers to storage participation in wholesale markets and FERC Order 2222 allowed distributed energy resources to participate alongside traditional resources in wholesale markets. States have used different procurement methods to incentivize BESS deployment and to engage the private sector, including competitive tenders and auctions. Competitive tenders formally indicate the quantity of energy supplied by BESS but are complex and time intensive. Auctions may receive lower prices on BESS projects but may exclude important qualitative factors like transmission requirements, BESS configuration, siting, permitting, and ownership considerations.

Figure 6: Achal Sondhi, Vice President of Growth, Fluence

The Roundtable then shifted focus to the U.S. private sector perspective. Achal Sondhi, Vice President of Growth, APAC, Fluence, explained that engaging with the private sector is critical to financing and catalysing BESS growth in the U.S. market and the specific models, technologies, and structures that can help countries in Southeast Asia as they begin their battery-based energy storage journey. He also cited use cases of how BESS projects provide reliable and stable energy to the grid. For example, BESS provided stable energy during a severe storm in the Dominican Republic. Mr Sondhi also stated that the U.S. Southwest energy market is very mature as public policy and market conditions are conducive to incentivising BESS deployment. He discussed how different countries use different techniques to support BESS deployment to enable their energy transition. Some methods include offering competitive large-scale solar plus storage tenders or auctions, creating tax credits and tariff incentives, establishing safety standards that promote security and ensure quality, and creating state-mandated procurement targets.

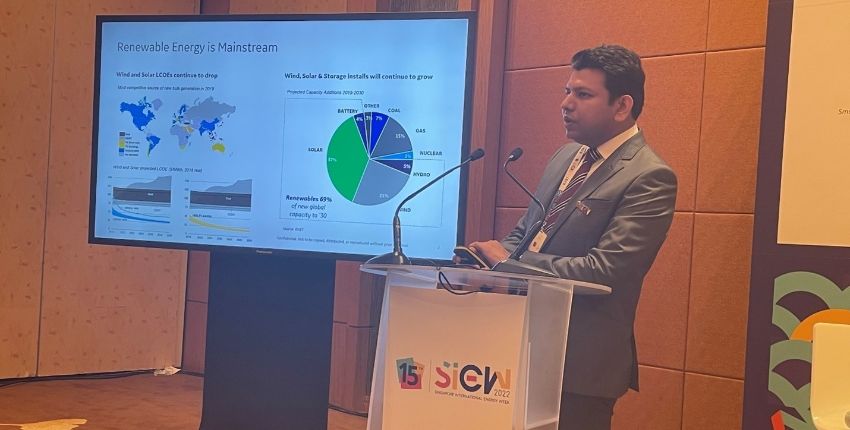

Figure 7: Shiv Aggarwal, Commercial Leader APAC Region, GE Renewable Energy

Shiv Aggarwal, Commercial Leader APAC Region, GE Renewable Energy, discussed BESS market developments. He explained that BESS and renewable energy costs generally are decreasing, which is leading to an increase in deployment. He expects that renewable energy and storage will amount to approximately 69 percent of global new energy capacity by 2030 due to the decrease in the levelised cost of energy. Renewable energy assets and BESS are displacing traditional sources of energy and their ancillary services. In one case study focusing on Ireland, BESS provides more opportunities for ancillary service revenue generation than traditional energy sources. Long-term BESS assets are critical to facilitate the energy transition as part of stable grid operations, and provide demand-side management, transmission and distribution connectivity, and zero-carbon resource diversity. Similarly, BESS can provide different applications, including capacity firming, frequency regulation, peak shaving, and demand response. Regulators should consider payment mechanisms to incentivise BESS growth, which will further accelerate renewable energy integration into the grid.

Figure 8: JD Brannock, Director of Storage Development, Leeward Renewable Energy, LLC

JD Brannock, Director of Storage Development, Leeward Renewable Energy, LLC, discussed the various market conditions across the U.S.. He discussed that utilities face two different types of risks when considering BESS technology risks and revenue risks. To mitigate technology risks, utilities need to clearly articulate the intended purpose of the BESS and develop plans for how to integrate BESS into the grid. Once utilities establish parameters around the BESS technology and its technological requirements, they should consider how BESS will generate revenue through its applications and services. BESS can provide a range of services including load shifting, energy arbitrage, grid firming, and frequency regulation. BESS can generate more value when used to provide multiple services, so utilities should consider opportunities to stack revenue-generating services. Different markets have different factors that catalyse BESS growth. For instance, public policy in Texas drives utilities to procure storage directly or through long-term contracts. In another case, the State of New York mandated a BESS roadmap to drive BESS deployment. A roadmap provides a market signaling opportunity that allows the commercial sector to prime for investment in that jurisdiction. It also provides an opportunity to develop preferences for use cases and applications and helps resolve barriers to deployment.

Figure 9: Ir. Ts. Abdul Razib bin Dawood, Chief Executive Officer, Energy Commission, Malaysia

Ir. Ts. Abdul Razib bin Dawood, Chief Executive Officer, Energy Commission, Malaysia, shared Malaysia’s perspective, and plan to deploy BESS. The Energy Commission expects to face grid stability issues once renewable energy, from solar and wind assets, comprises approximately 30 to 40 percent of energy penetration and BESS is critical in achieving Malaysia’s renewable energy ambitions. Malaysia intends to use BESS for grid firming to stabilise the grid. Malaysia also conducted an initial study that identified a pilot BESS investment opportunity on the Malaysian peninsula to help demonstrate the viability of BESS assets in stabilising the grid. He cited support from ENR to develop capacity and share leading practices on hybrid storage and BESS applications, business model options, revenue model analysis, commercial and contractual frameworks, and functional specifications.

Figure 10: Dr. Narin Phoawanich, Assistant Governor, Fuel Management, Electricity Generating Authority of Thailand

Dr Narin Phoawanich Assistant Governor, Fuel Management, Electricity Generating Authority of Thailand stated that BESS will be instrumental in achieving Thailand’s National Energy Plan 2022. To reach carbon neutrality by 2050, Thailand intends for renewable energy coupled with energy storage, to comprise approximately 50 percent of its energy mix, have electric vehicles account for 30 percent of its automotive production by 2030, and achieve greater energy efficiency in buildings. Thailand will implement these goals through its Digitalisation, Decarbonisation, Electrification, Decentralisation, and De-regulation (4D1E) strategy. As part of its decarbonisation goals, Thailand will integrate BESS with its renewable energy resources. Thailand has two BESS pilots to demonstrate the delivery of secure and stable energy. Dr Phoawanich identified several opportunities that BESS provides, including more resilient supply chains, economic growth, more affordable electric vehicles, and reduced carbon emissions.

Figure 11: Panel Discussion Moderated by Chris Davy, Director for the Middle East and Asia, ENR, U.S. Department of State

Chris Davy, Director for the Middle East and Asia, ENR, U.S. Department of State, moderated the panel discussion. Panelists from left to right include:

- Chris Davy, Director for the Middle East and Asia, ENR, U.S. Department of State;

- Ir. Ts. Abdul Razib bin Dawood, Chief Executive Officer, Energy Commission, Malaysia;

- Dr Narin Phoawanich, Assistant Governor, Fuel Management, Electricity Generating Authority of Thailand;

- John Garvey, Legal and Regulatory Specialist, Deloitte, on behalf of U.S. Department of State, ENR, Power Sector Program;

- Shiv Aggarwal, Commercial Leader APAC Region, GE Renewable Energy; and

- Achal Sondhi, Vice President of Growth, APAC, Fluence.

During the Roundtable, speakers discussed how BESS is critical to achieving renewable energy targets in the region and how to encourage private sector participation in the market. Public sector speakers noted that in response to increasing fuel prices, renewable energy assets coupled with BESS have become a more appealing source of low-cost energy.

These speakers also noted that one difficulty the region faces is funding capital-intensive BESS projects and is considering pairing BESS with existing infrastructure to reduce overall capital costs. The private sector speakers note that utilities can also attempt to bring down soft costs (e.g., permitting, interconnection) to reduce the overall cost of a BESS project. In this regard, Mr Sondhi noted that the optimal pilot size for a BESS project is between 20 – 30 MW because soft costs for this size of a project are approximately the same as smaller-scale BESS projects.

While Southeast Asia is rich with renewable energy resources, including wind, solar, and hydropower, the private sector is looking to capitalise on those resources by identifying opportunities to implement BESS from utilities and the public sector. The public sector can send positive signals to developers by publishing their decarbonisation goals, developing a roadmap, and expressing goals for BESS deployment.

Mr Goh concluded the Roundtable by thanking participants for their presentations and insights and noting Singapore’s interest in working together with its partners in the region to develop BESS.

[1] U.S. Energy Information Administration, “US EIA Form 860M,” August 2022, Preliminary Monthly Electric Generator Inventory (based on Form EIA-860M as a supplement to Form EIA-860) - U.S. Energy Information Administration (EIA)